Dear Investor,

Thank you for being a believer in the infrastructure growth story of India and investing your money in DSP India T.I.G.E.R. Fund (The Infrastructure Growth and Economic Reforms Fund).

As the fund celebrated its 20th year anniversary on Jun 11, 2024, we wanted to write to all our investors in this fund over the years, to share our gratitude and some reflections.

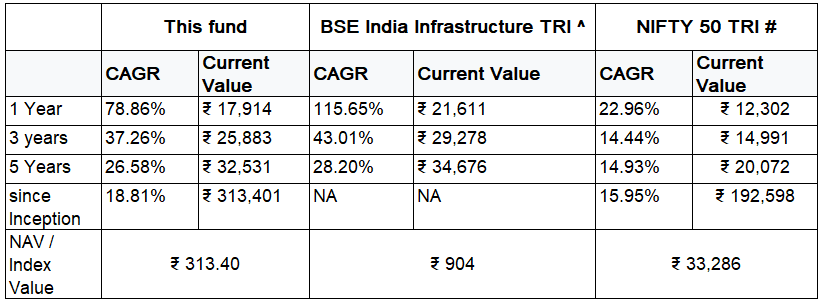

Over the two decades, we have hunted for opportunities on your behalf in the infrastructure and manufacturing theme. Today, DSP India T.I.G.E.R.# Fund has delivered over ~18% CAGR1 returns year on year since it came into existence 20 years ago (since inception from June 11, 2004). This means an initial investment in the fund at inception has grown to over 31 times its value today.

Infrastructure development in India has been and remains a continuous story and our growth is now visible across expressways, metros, airports and deepening urban-rural connectivity. With time and India’s progress, this Fund has also broadened its focus to Power, Defence, Energy, Aerospace, Logistics, Storage as these sectors have also gained relative momentum.

Today, we are well positioned to capitalize on emerging opportunities, which could come from a confluence of several positive factors such as:

- Stable macro-economic climate

- Under-leveraged corporate balance sheets

- Lower NPAs

- Accumulative benefit of several pro-growth policies on taxation, labour, corporate insolvency

There also is a massive swing in India’s favour relative to China, in how the western world is looking eastwards. This has potential to bring in capital, technology and open large demand markets for Indian entrepreneurs as global supply chains may diversify away from China. This could add on to India’s manufacturing transformation, which is likely to be many times bigger than what we have seen in pure infrastructure.

In defence, we are seeing indigenous orders placed by the government to reduce imports and create an environment for companies to export several defence products like Tejas aircrafts and Akash missiles in a cost-efficient manner.2

India’s government is also using a “do whatever it takes” approach to kickstart the full range of the electronics value chain in India right from semiconductor chips to final assembled products like mobiles and laptops. Apple’s choice to add India as one of the manufacturing destinations for its global supplies is a shining example for other global firms to follow.

Indian engineering and chemicals firms are expanding their capabilities with significantly enlarged capital expenditure and building on opportunities in their specific niches.

Whichever way one looks at it, the continuing growth potential behind the DSP India T.I.G.E.R.# Fund themes of infrastructure growth, economic reforms, manufacturing, and more is undeniable and poised to grow.

The theme of infrastructure and economic reforms in India in 2004, when our fund launched, looked so different from where we are today- a sign of our nation’s exceptional progress. So, we are aiming to ensure that twenty years later, in 2044, we may be able to highlight a totally different set of opportunities, some that have probably not even emerged yet.

But through all these evolving times, our goal remains the same: To continuously identify the right opportunities and stocks within these themes that could create a long-term value for you.

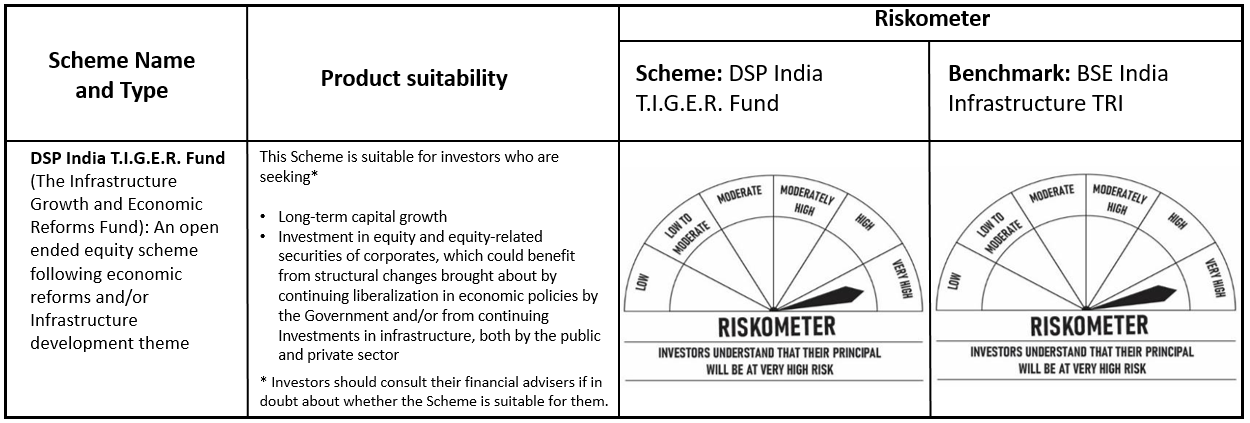

In today’s context, there’s another factor worth underlining- the themes that drive DSP India T.I.G.E.R.# Fund are significantly under-represented in the broader Nifty 50 Index. Hence, it makes sense for investors to consider this fund, with its focus on these very areas.

As we continue to navigate this journey along with a growing, developing India, we believe more opportunities will present itself and we want you and your portfolio to be formidable, just like a tiger.

And if your thinking remains aligned with the way we manage this fund, please do keep investing with us to reach our shared vision of healthy wealth creation. Your trust fuels our dedication to do what we do, diligently.

Once again, we want to thank you for being with us all these years.

Together, let us embrace the future with optimism and resilience.

Warm regards,

Rohit Singhania

Charanjit Singh

Fund managers- Equity, Team DSP3