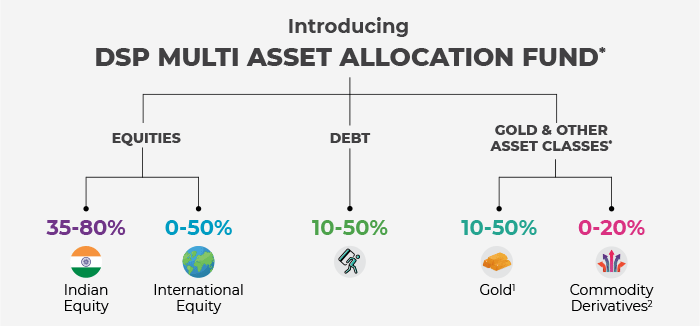

- 1 Gold ETFs & other Gold related instruments (including ETCDs)

- 2 Other Commodity ETFs, Exchange Traded Commodity Derivatives (ETCDs)

*Scheme can also invest upto 10% in units of REITs & InvITs. The investment approach / framework/ strategy / portfolio herein are dated and proposed to be followed by the scheme and the same may change in the future depending on the market conditions and other factors.

For more details on asset allocation pattern, please refer scheme information document.

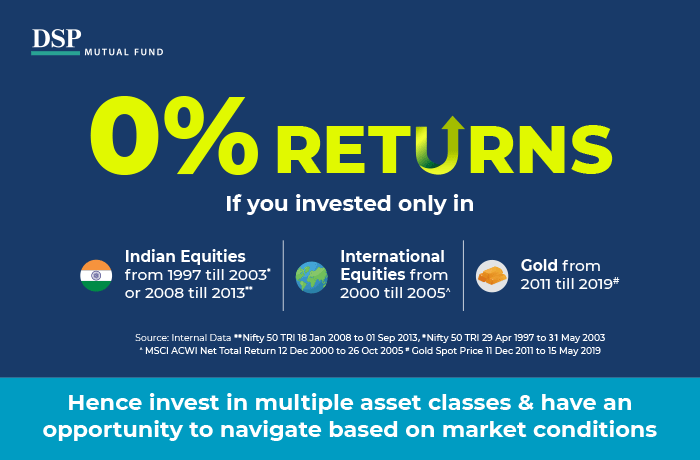

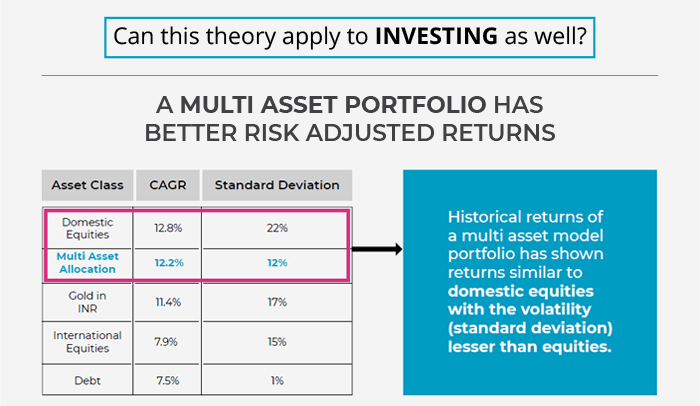

Data period considered from 1st Jan 2000 to 31st July 2023. Source - DSP Internal. Nifty 50 TRI, CRISIL Ultra Short Duration Debt B-I Index, XAU/INR, MSCI ACWI TRI considered for Indian Equities, Indian Debt, Gold & International Equities in ratio 50%,15%,20%,15% respectively for Multi-Asset portfolio. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index.

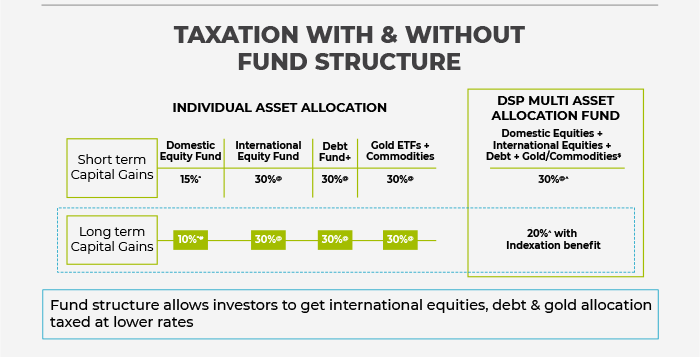

* Long term capital gain after 1 year holding period @ It is assumed investor is taxed at maximum marginal rate of tax. ^ Long-term capital gain after 3 year holding period. Surcharge & cess will be over and above the base tax rate as mentioned above. # Long term capital gain applicable for gain in excess of Rs.1 lac, + Specified Mutual Fund. Surcharge & Health & Education Cess will be over and above the base tax rates as mentioned above. $For complete details on asset allocation pattern for scheme, refer scheme information document.

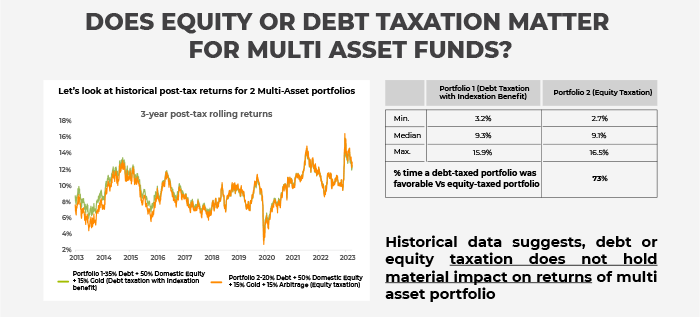

Data as on 31 Jul 2023. Source - DSP Internal. Nifty 50 TRI, CRISIL Short term Bond Index, XAU/INR, Nifty Arbitrage Index considered for Indian Equities, Indian Debt & Gold respectively. Current taxation rates for equity-oriented fund and debt funds (with indexation benefit) have been considered. Historically, taxation rates have been different. It is assumed that investor is taxed at Maximum marginal rate of tax. Surcharge has been excluded for the above calculation. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of the schemes of the DSP Mutual Fund.

|

Disclaimers This note is for information purposes only. It should not be construed as investment advice to any party. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. The sector(s)/stock(s)/issuer(s) mentioned in this note do not constitute any research report/recommendation of the same and the schemes of DSP mutual fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). Large-caps are defined as top 100 stocks on market capitalization, mid-caps as 101-250 , small-caps as 251 and above. Data provided is as on Jul 31, 2023 (unless otherwise specified) The figures pertain to performance of the index and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index. All opinions, figures, charts/graphs and data included in this note are dated and are subject to change without notice. For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, Statement of Additional Information and Key Information Memorandum of respective scheme available on ISC of AMC and also available on www.dspim.com. There is no assurance of any returns/capital protection/capital guarantee to the investors in above mentioned Scheme. The document indicates the strategy/investment approach currently followed by the above mentioned Scheme and the same may change in future depending on market conditions and other factors. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of the schemes of the DSP Mutual Fund. |

||||||||||||

|

||||||||||||

|

^ Benchmark - 40% NIFTY500 TRI + 20% NIFTY Composite Debt Index + 15% Domestic Price of Physical Gold (based on London Bullion Market Association (LBMA) gold daily spot fixing price) + 5% iCOMDEX Composite Index + 20% MSCI World Index The product labelling assigned during the New Fund Offer (‘NFO’) is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made. |

||||||||||||