India & Oil In ‘War Year’

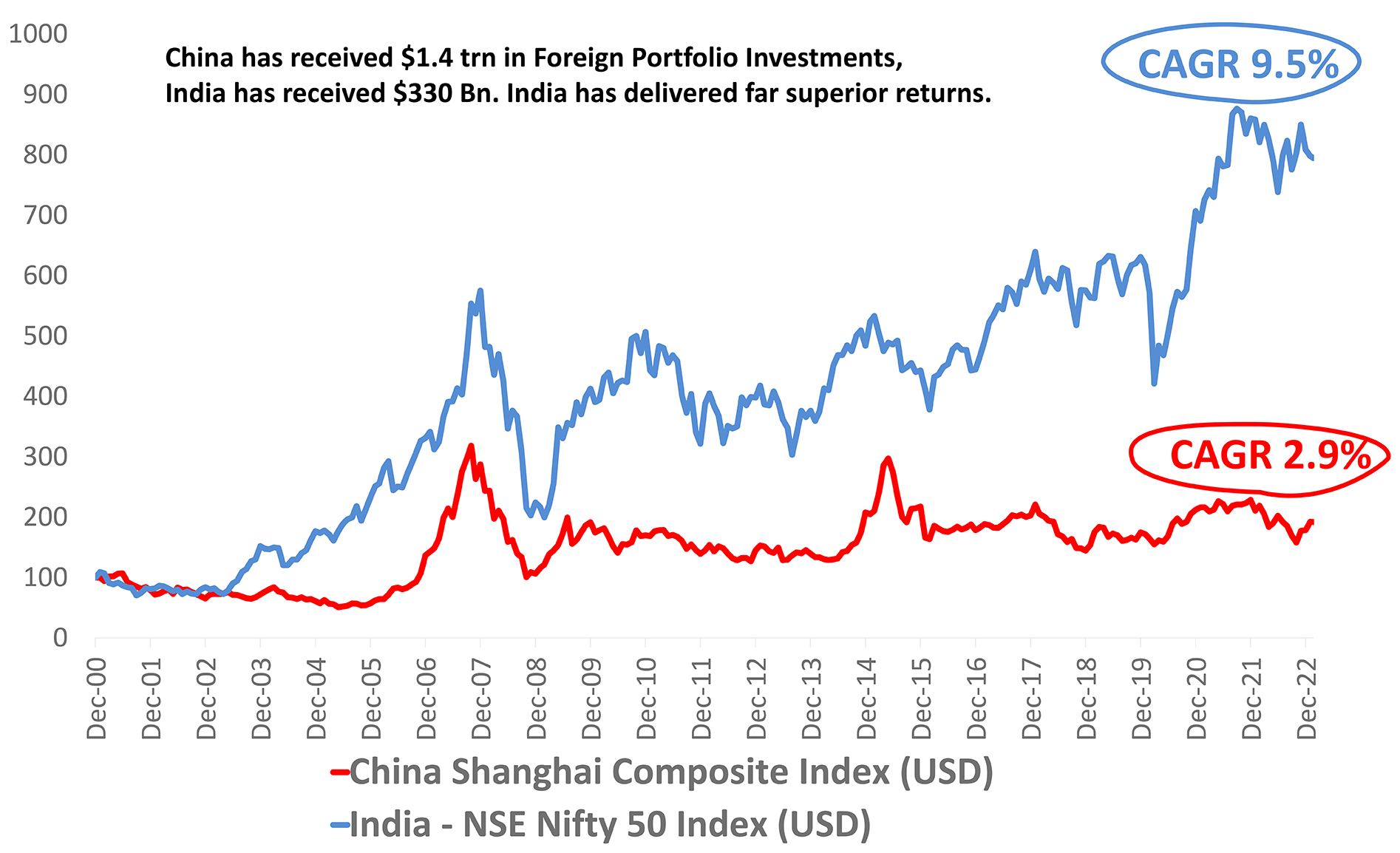

India Has Delivered Returns To Investors

China has been the hottest investment destination since its entry into the WTO. It has grown at such a ferocious pace that no country has ever done it before.

It has received the largest share of global investment flows outside of the US over the last two decades. But when it comes to delivering returns, it faces steep competition.

A number of global investors are unclear as to who is the ultimate beneficiary of business profits in China and whether Chinese businesses are profit-focused.

There is a case for India, which has delivered superior returns, to receive a higher share of global investment going forward because of its free market & businesses focused on profits.

Source: Bloomberg Data as on Feb 2023

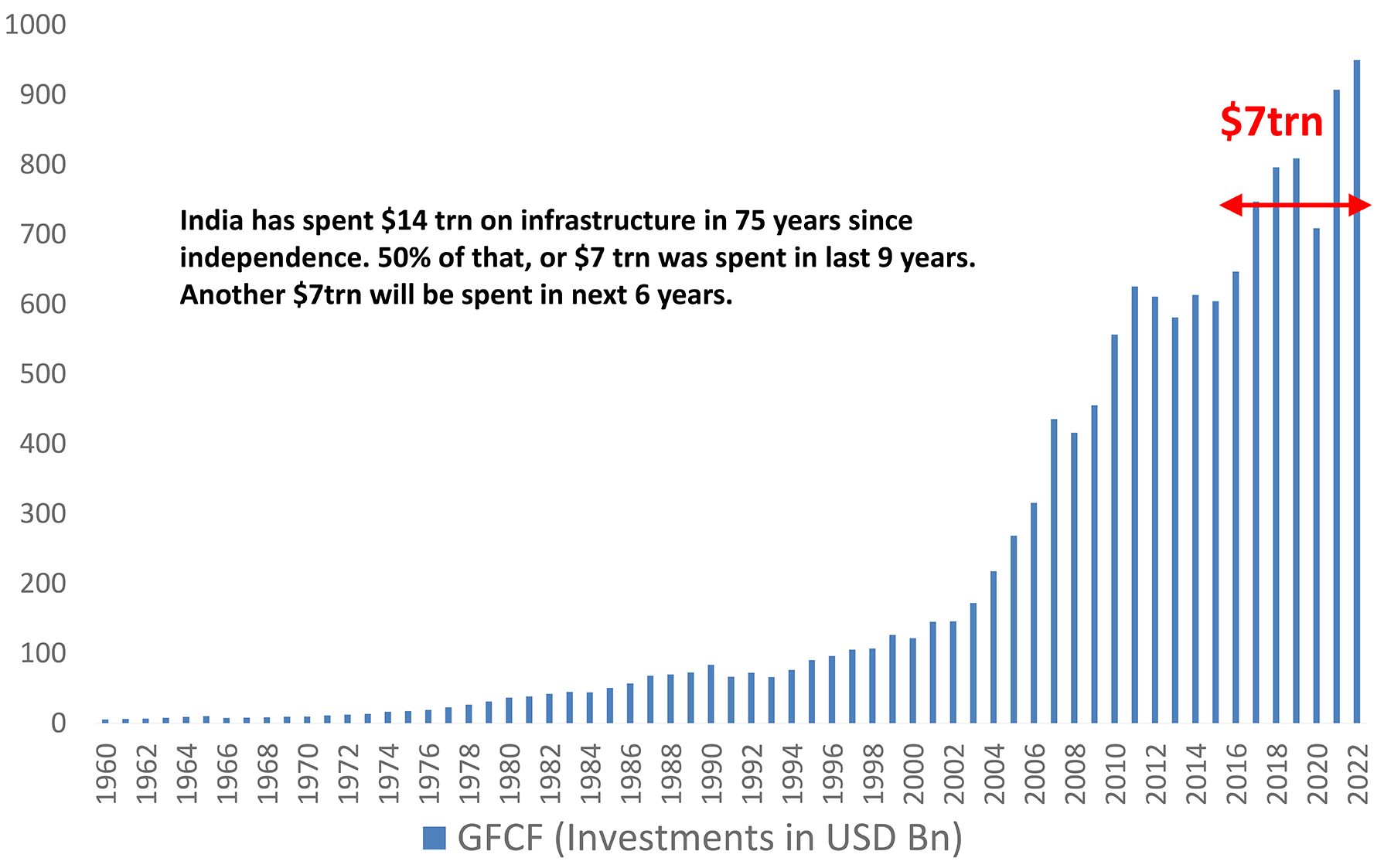

The Coming Investments Upsurge

India has come out of an investment winter. The investment to GDP ratio (measured by gross fixed capital formation to GDP) peaked in 2011 & remained low until COVID-led disruption upended the supply chains. Post COVID recovery & a large push through government expenditure, investments are making a come back.

There has been a spend of $14 trn on investments since independence. This includes spending on housing by households, infrastructure creation by the government, & private capital expenditure.

In spite of poor investment growth over the last many years, India has spent $7trn on new investments over the last 9 years. As the base becomes large this number will repeat itself in the next 6 years.

What does this mean? The capex cycle is likely to surprise on the upside in the next few years.

Source: World Bank, Govt Documents Data as on Feb 2023

Corporate India Has De-levered

Record profitability in FY22 and the paring down of corporate debt have improved the financial health of corporate India.

The Net Debt to EBITDA levels have halved from pre-covid levels & Net debt levels have fallen to a 6 year low.

This augurs well for the CAPEX cycle, as a healthy balance sheet & strong profitability open the door for corporate India to spend more.

It is quite likely that the government's capex push is complemented by private sector capex. This is likely to boost sectors involved in infrastructure and ancillary services.

Source: Bloomberg Data as on Feb 2023

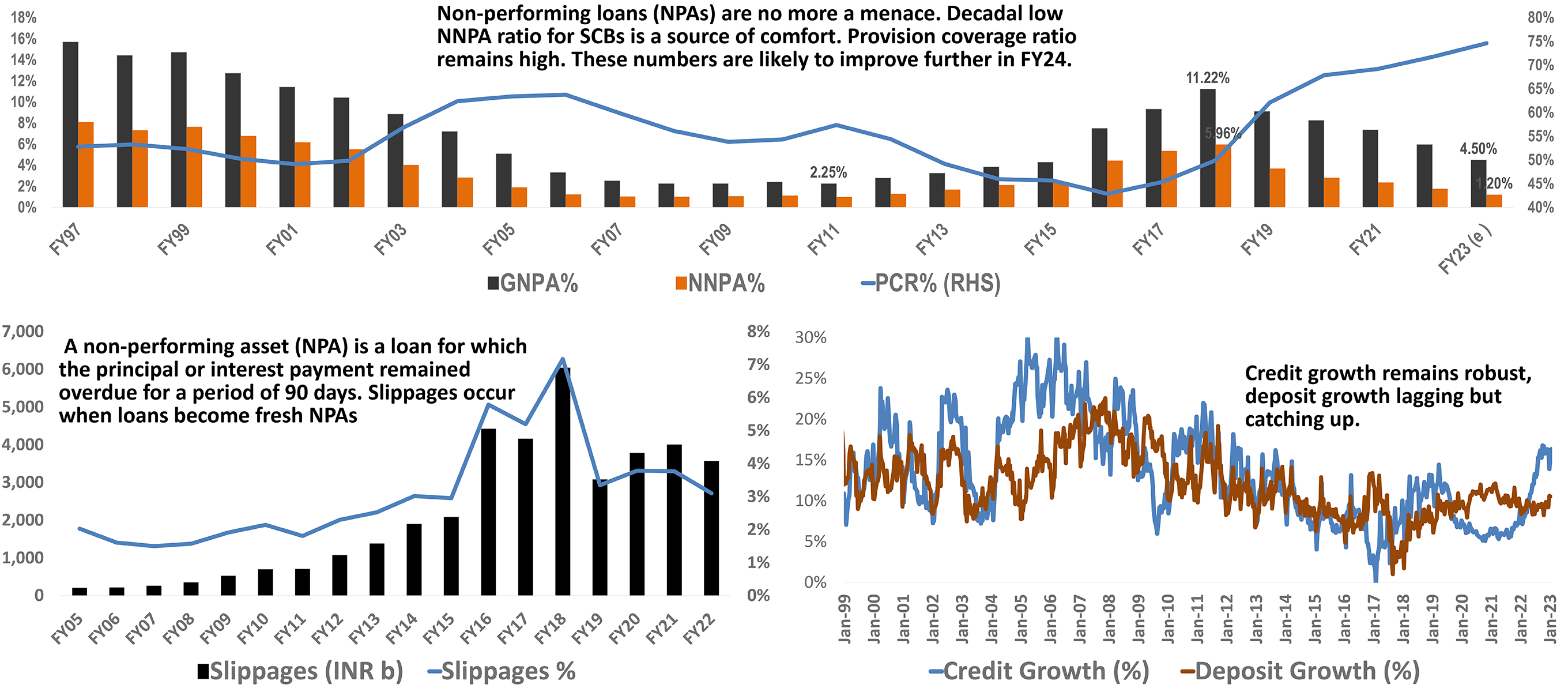

Banking Sector Is In Great Shape

Source: Investsec, DSP Data as on Feb 2023

India’s External Situation Likely To Normalize in FY24

High oil prices and a steep import basket of manufacturing imports caused India's trade deficit to balloon in FY23. Between April'22 to Dec'22, India recorded a monthly trade deficit of $27bn- a record.

Oil prices have since cooled off, and the normalization of supply chains is also reducing India's goods import bill. At the same time, India's services trade is racing towards record surplus.

A combination of a normalizing import bill and steady growth in service exports is likely to take pressure off India's current account. This is likely to benefit the Rupee in FY24 and give the RBI more options in managing India's external situation and FX policy.

Source: Bloomberg Data as on Feb 2023

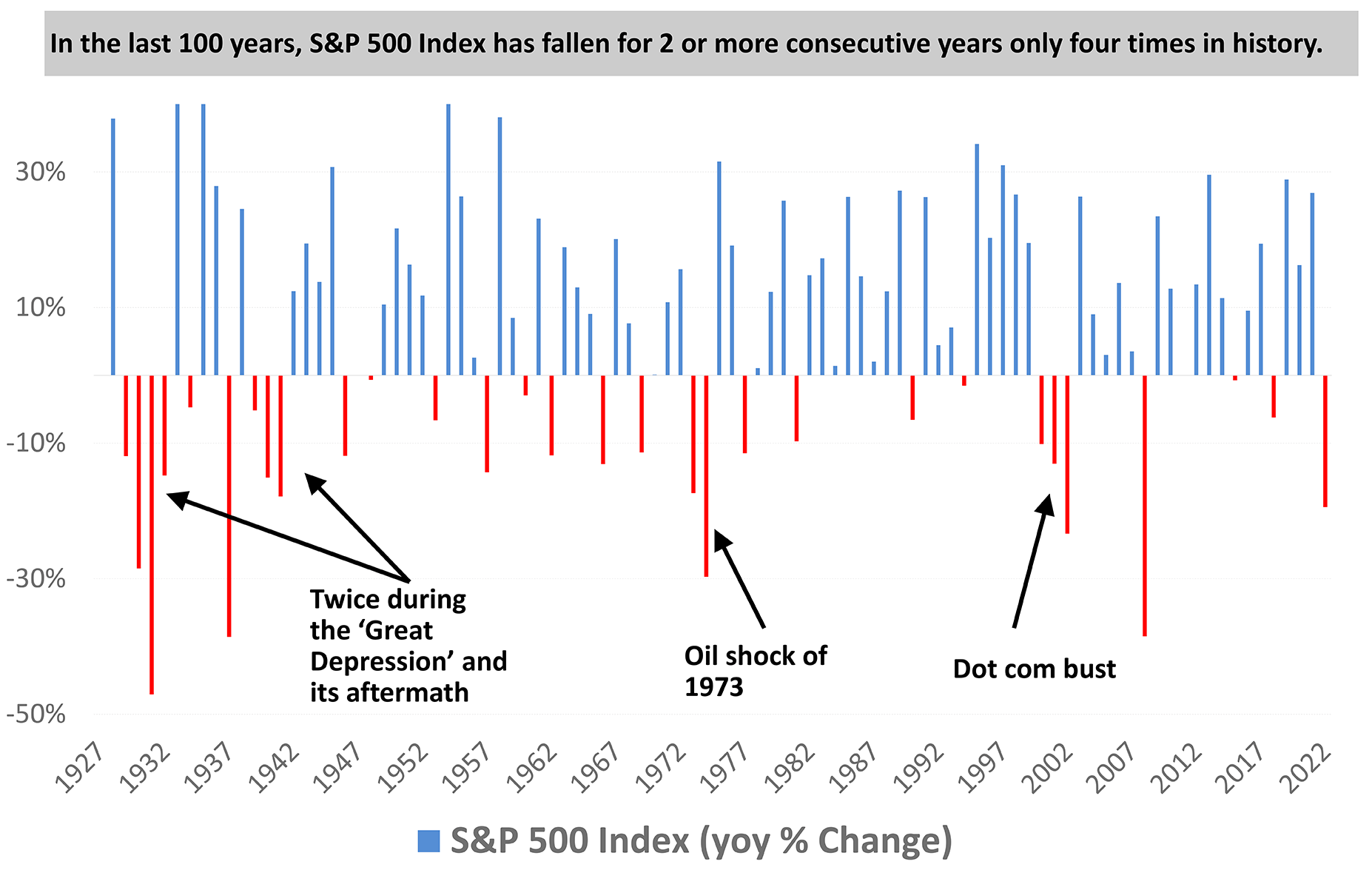

S&P 500 Index History Signals Equity Consolidation?

US equity markets remain the mother market globally, which sets the tone for investor sentiment.

Over the last 100 years, there have been four instances where US markets have delivered negative returns over two or more consecutive years. In CY 2022, US markets closed negative. If history is any guide, in CY 2023 it's quite likely that US equities remain in a broad consolidation rather than see deep correction.

This could provide some comfort to the rest of the world. Indian equities could benefit from a less volatile world on the back of strong earnings growth in India and improving valuations.

This means in a growth market like India, be attentive to valuations. Add equity exposure on market declines and valuation comfort.

Source: Bloomberg Data as on Feb 2023

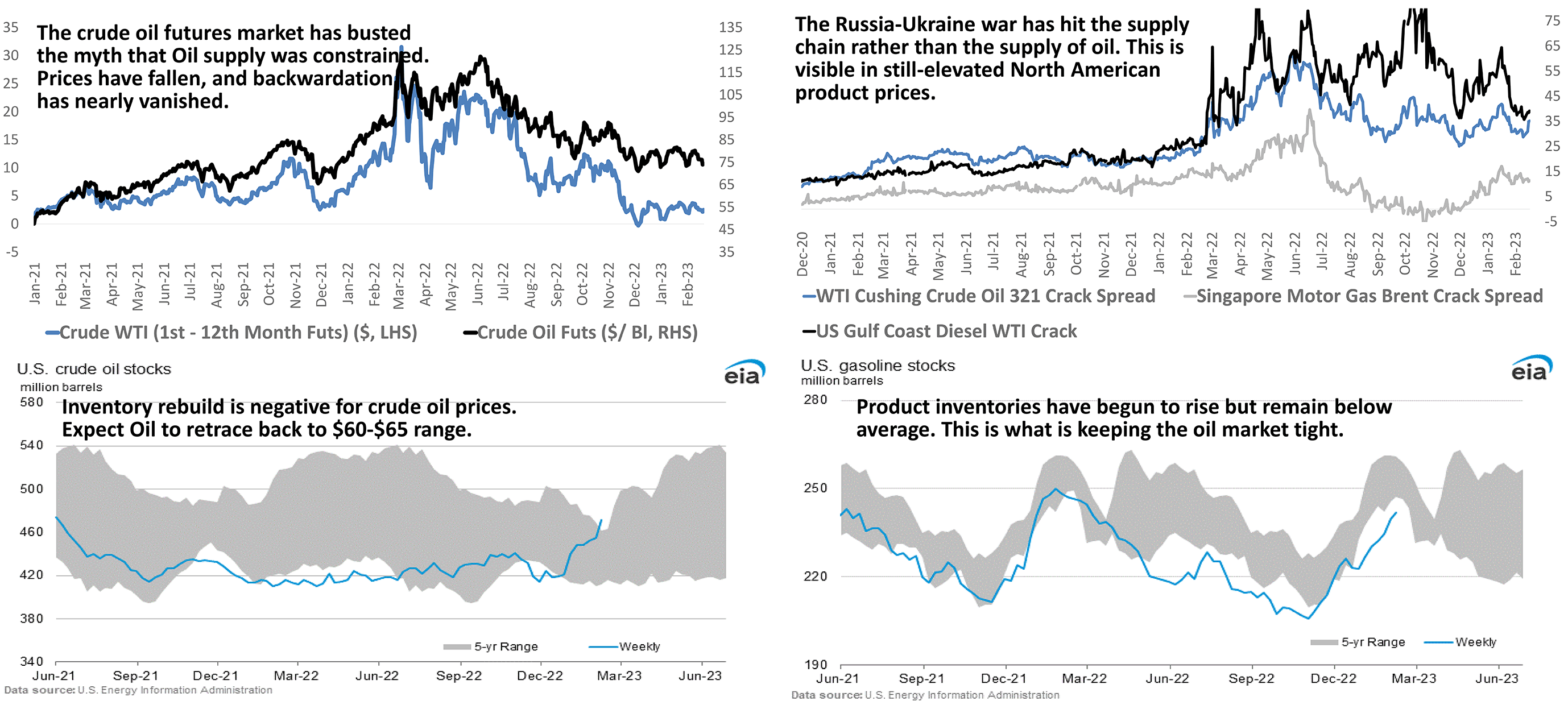

The Year of War & Oil Supply-Chain Reset

Source: Bloomberg, EIA, DSP Data as on Feb 2023

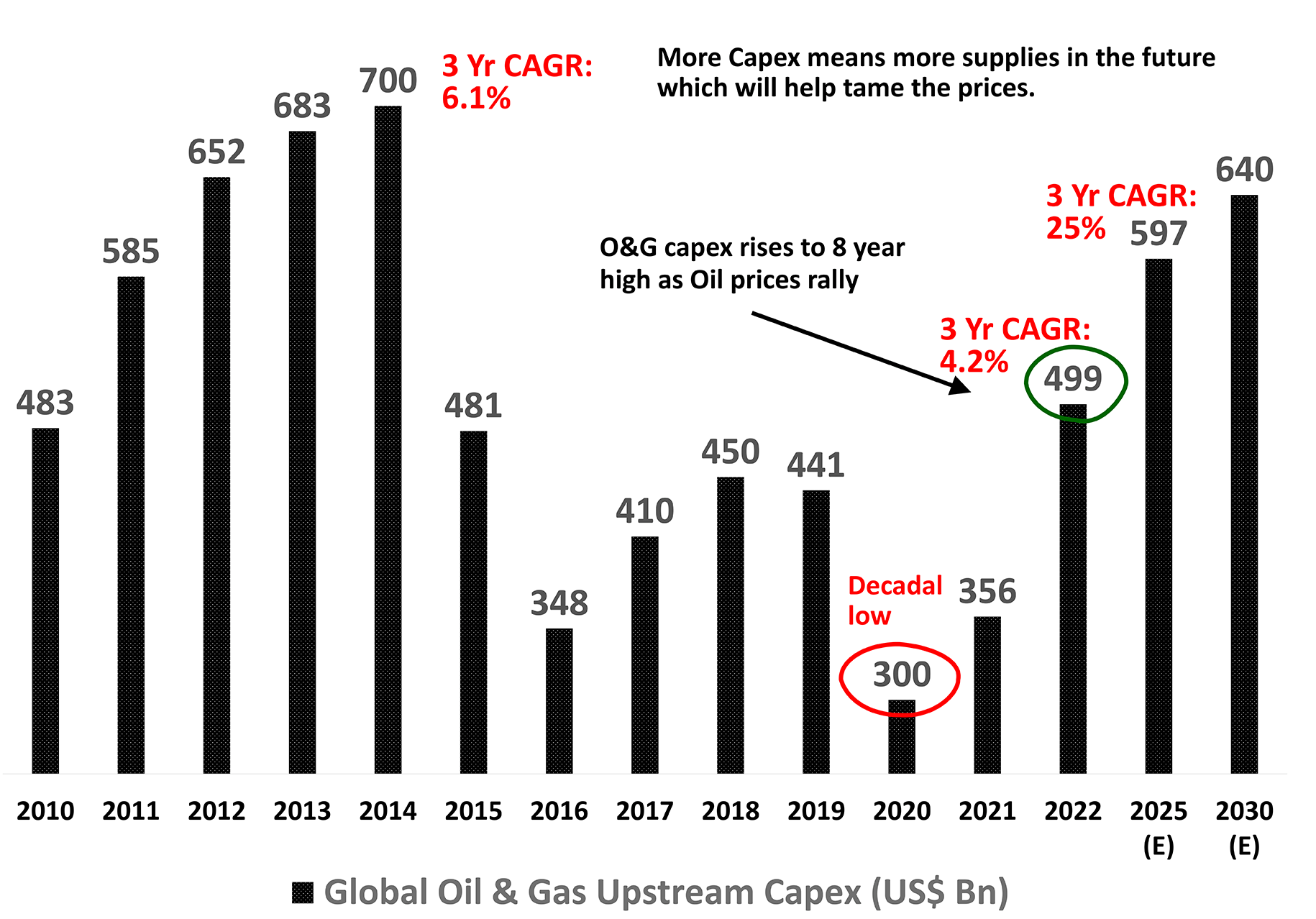

Oil & Gas Capex Is Back

Investment in the upstream oil & gas industry (companies that search for deposits of oil or gas and then its extraction through drilling or other methods) had started recovering after the rise in oil & gas demand amid the opening of the COVID-19 lockdowns.

An increase in demand recovered crude oil prices in 2022. For instance, in 2020, crude oil prices were about USD 41.96 per barrel, and in 2022 the prices reached more than USD 110 per barrel, which resulted in a surge in investment in the oil & gas industry.

The year 2022 was dominated by oil and gas majors returning capital to shareholders through buybacks and dividends. The latest trends suggest that a wave of capital expenditure is likely to put the spotlight back on raising capacity and easing supply-side uncertainty in the energy market.

Source: IEF & S&P Global Commodity Insights, Data as on Feb 2023

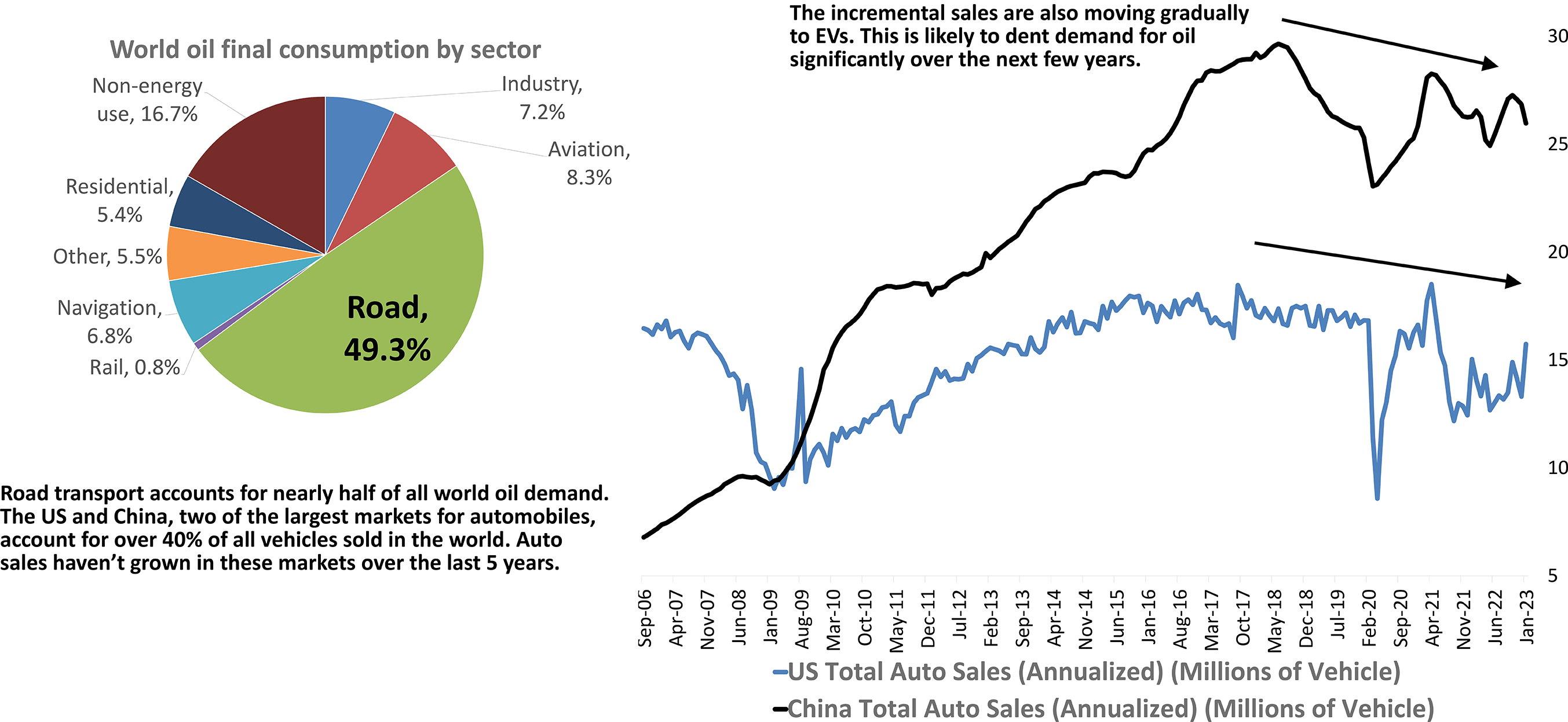

Auto Sales In The Two Largest Markets Are Stagnant

Source: Bloomberg Data as on Feb 2023

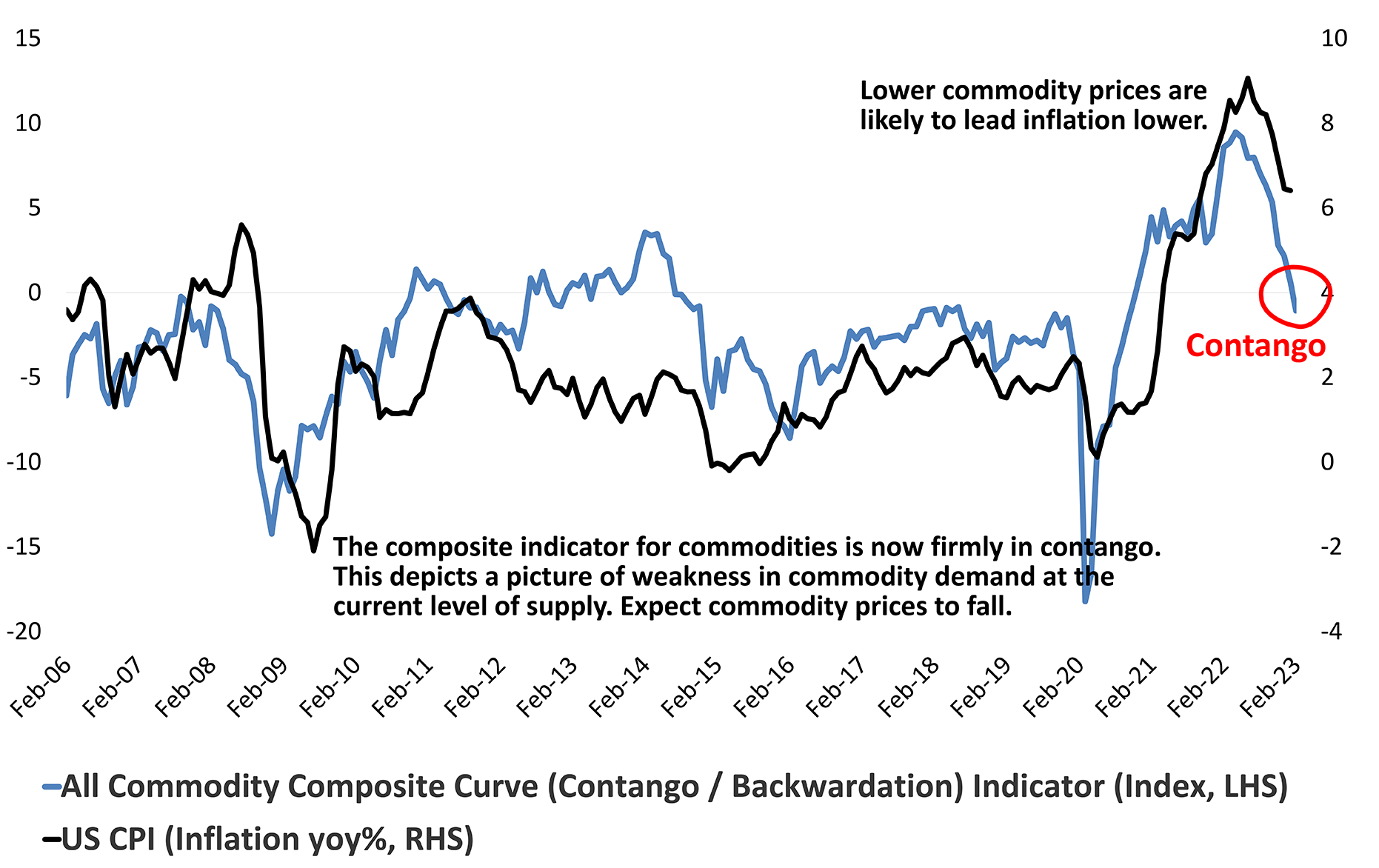

Commodity Curves Signal Inflation Deceleration

Backwardation: A condition in which the futures market is abnormal. This happens when the price of the futures contract, which is months away, trades at a discount to the near-month prices. Since commodities entail a storage cost, called the "cost of carry“, ideally, they should be more expensive in the future. Backwardation causes current prices to be higher than the prices of all futures contracts. This is a bullish condition. In 2022, a "supply crunch" caused backwardation.

From the composite curve of commodity futures, it is now visible that backwardation is gone, and commodities are back in contango. Contango is a normal market condition and usually coincides with normalized levels of inflation.

This means stickiness of inflation may not last long.

Source: Bloomberg Data as on Feb 2023

More Information ≠ Better Outcomes

Source: WHO

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us