DSP NETRA JUNE 2023

"A dwarf standing on the shoulders of a giant may see farther than a giant himself." - Diego de Estella

“Play long-term games with long-term people. All returns in life, whether in wealth, relationships, or knowledge, come from compound interest.” - Naval Ravikant

We had a conversation with one of our colleagues who has been part of the DSP Group for over 20 years. He chose to remain with this organization because it has evolved alongside him, and he has developed along with the organization. He expressed strong emotional attachment, intellectual stimulation & professional empowerment. He feels the bond is real.

It's noteworthy that the DSP Group has a remarkable 163-year history and is currently in its 17th decade of continuous growth.

Long-term players make each other rich.

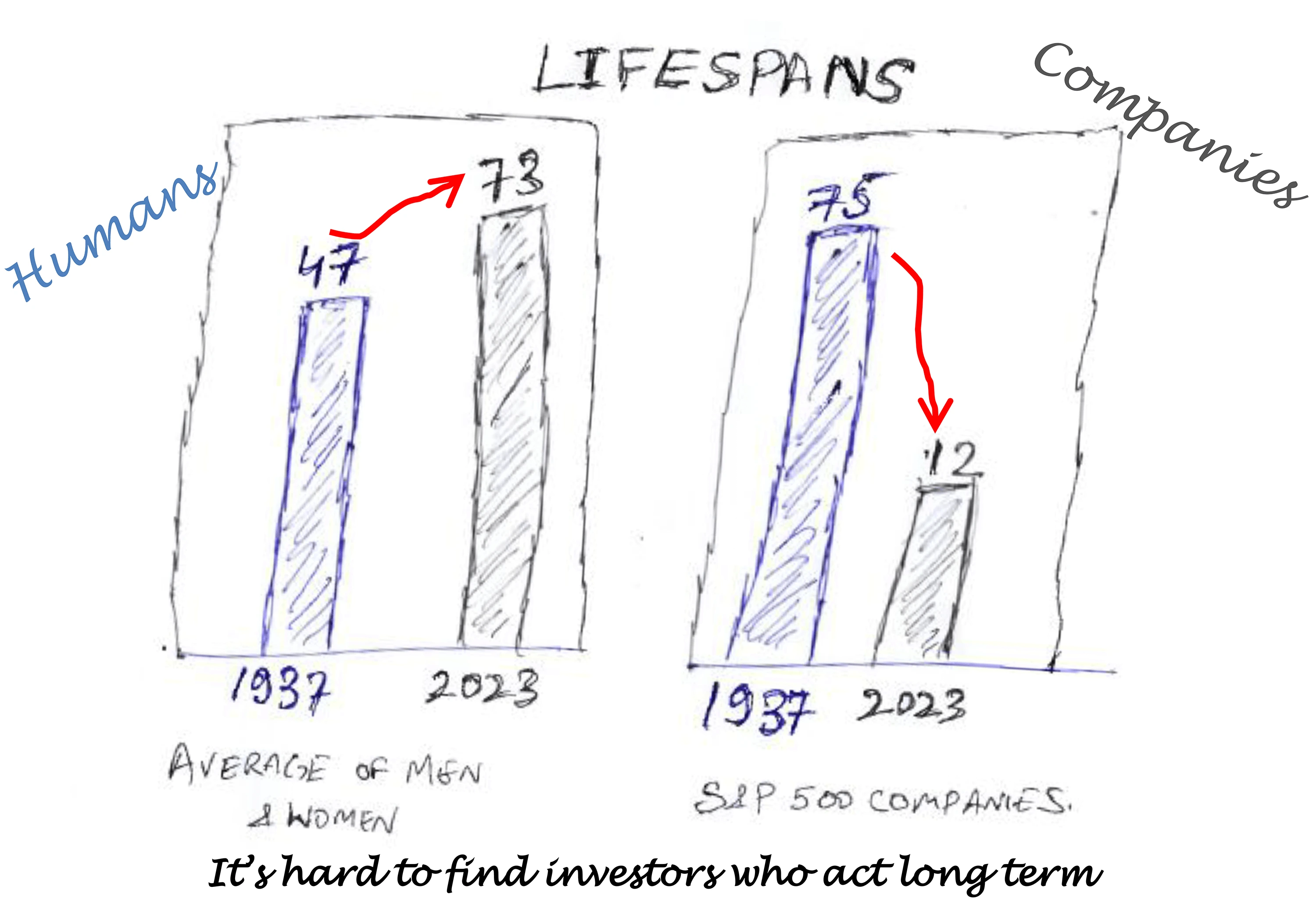

Over the course of the 21st century, humans are living longer. Human mortality has declined & is probably going to decline further & faster. Average lifespan is increasing. But firms are dying quickly or are getting ‘disrupted’ at the fastest pace ever. It’s hard to find people or organizations that are in it for the long term.

If you find them, stick to them.

Source: DSP, McKinsey, Data as on May 2023

“Don't give me timing, give me time.“ - Jesse Livermore

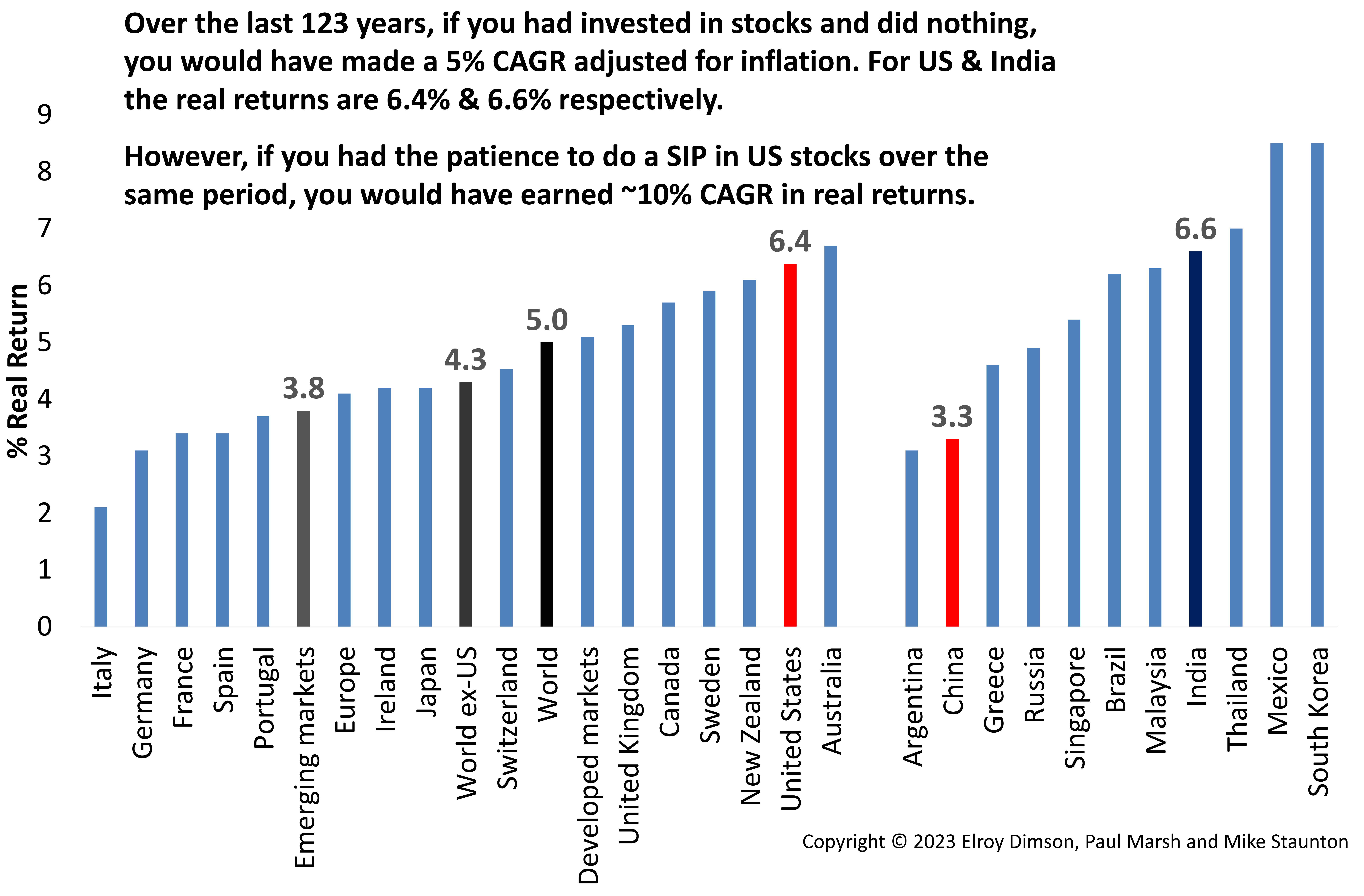

In India, most debates about long term returns end up with investors thinking or asking for 12% to 15% CAGR returns.

Data for the last 123 years shows that pre-cost and pre-tax ‘REAL’ returns for the world equity markets are ~5% CAGR. This is an excellent rate of return to compound one's wealth over a century, given that one has the patience to not interrupt the compounding process.

Most family offices running generational wealth believe that simple ‘Dollar Cost Averaging’ or the humble SIP is a tool for retail investors. History shows that if one were to do a SIP in US equities over the last 123 years, it would have generated a near ~10% inflation adjusted CAGR. This means a humble $100 invested turns into $11.8 million over this period, with its purchasing power intact!

Time spent in the market is truly a wonder, but only if we set our expectations right.

Source: DQDYDJ, NBER, Credit Suisse (Copyright © 2023 Elroy Dimson, Paul Marsh and Mike Staunton), DSP Data as on May 2023

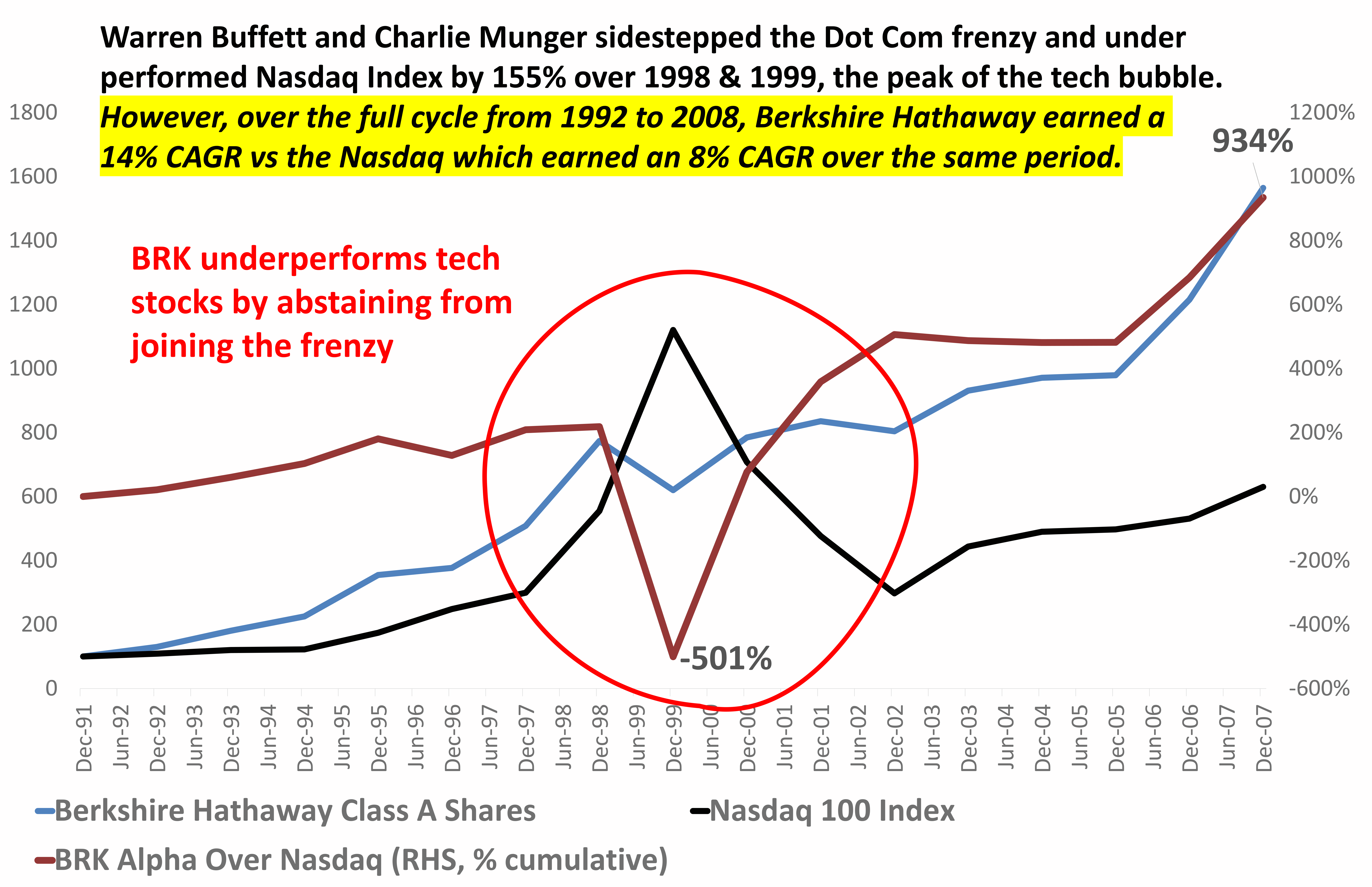

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.“ - Charlie Munger

"The line separating investment & speculation, which is never bright and clear, becomes blurred still further when most market participants have recently enjoyed triumphs. Nothing sedates rationality like large doses of effortless money. After a heady experience of that kind, normally sensible people drift into behavior akin to that of Cinderella at the ball

They know that overstaying the festivities - that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future -will eventually bring on pumpkins & mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There's a problem, though: They are dancing in a room in which the clocks have no hands“!

—Warren Buffett, At the time of Dot Com bust

Source: BRK, Nasdaq, DSP as of May 2023

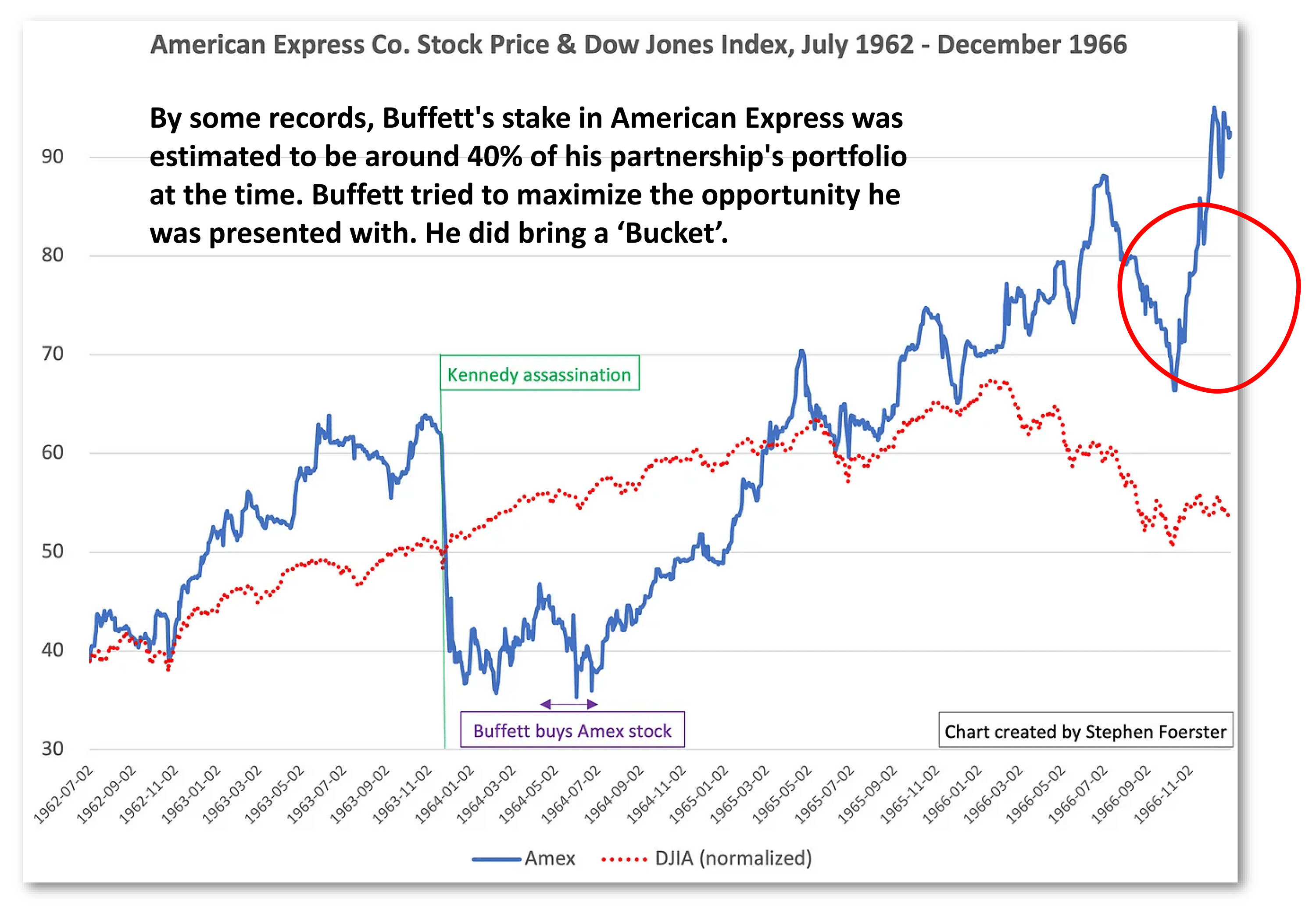

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” - Warren Buffett

As a result of the losses American Express suffered from funding De Angelis’ Allied Crude, American Express stock fell in price from $65 in Oct 1963 to $37 in Jan 1964. Believing this was temporary. Buffett began buying shares & established a 5% stake in American Express for $20 million. Allied Crude was responsible for Salad Oil scandal.

"There was one other little wrinkle that was terribly interesting. American Express was not a corporation. It was then the only major publicly traded security that was a joint-stock association. As such, the ownership of the company was assessable. If it turned out that the liabilities were greater than the assets, [then] the ownership was assessable. So, every trust department in the United States panicked. I remember the Continental Bank holding over 5% of the company, and all of a sudden, not only did they see that the trust accounts were going to have stock worth zero, but they could get assessed. The stock just poured out, of course, and the market got slightly inefficient for a short period of time."- Warren Buffett on American Express during the Salad Oil Scandal

Source: DSP, Mark I. Weinstein, Stephen Foerster

“…Funda Ka Ho Gaya Mental…” - Rakesh Jhunjhunwala

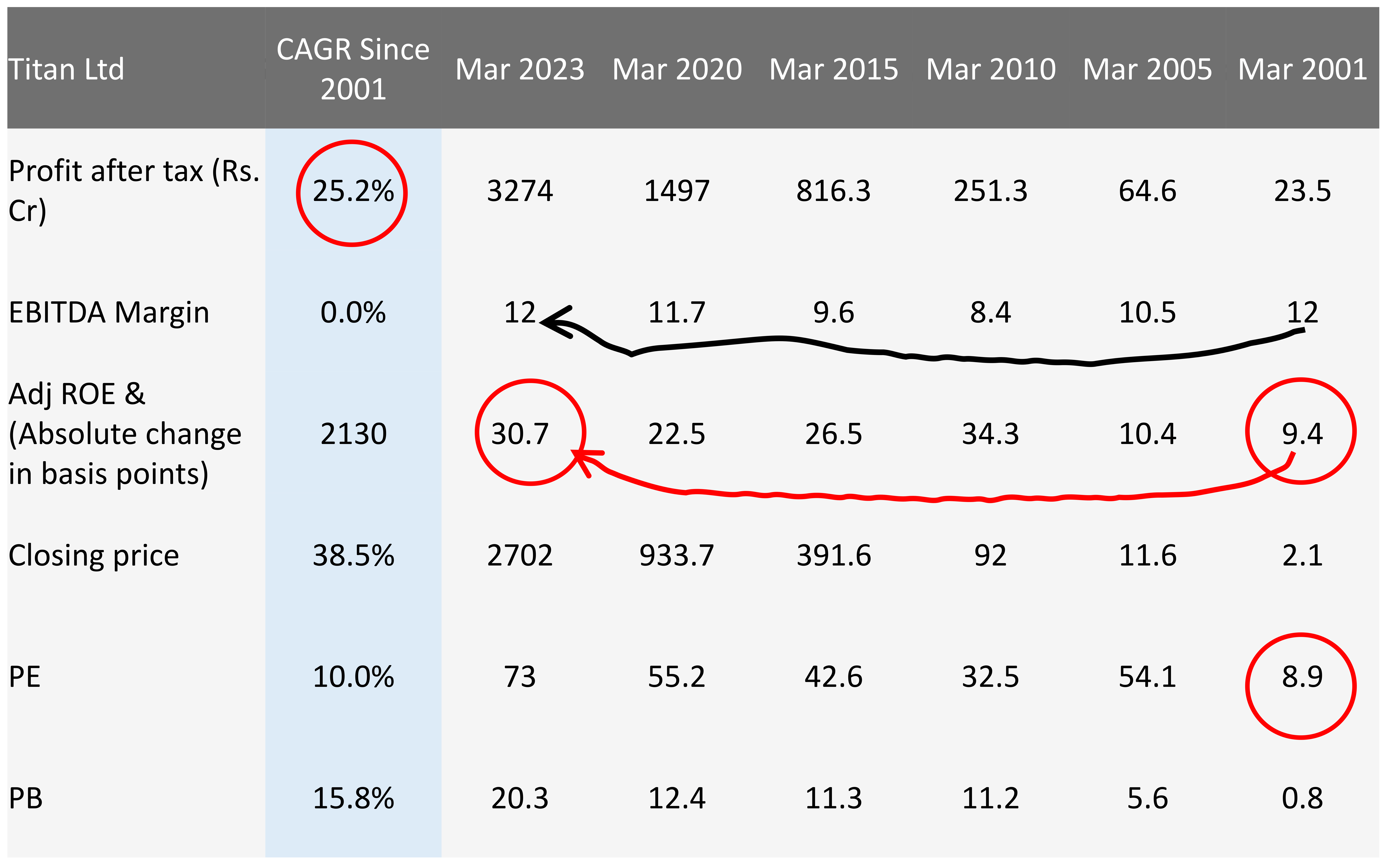

Rakesh Jhunjhunwala, popularly known as "The Big Bull," has amassed tremendous wealth by strategically holding onto select high-quality businesses over extended periods. Among his notable investments is Titan Ltd.

Jhunjhunwala's famous quote, "Funda Ka Ho Gaya Mental," serves as a real-life testament to the futility of second-guessing market moves. Instead, he advocates staying invested throughout market cycles by adhering to two fundamental principles:

1. Avoiding overpayment: By not paying excessive

prices for investments.

2. Acquiring high-quality businesses: Focusing on

companies with the resilience to withstand

market fluctuations.

This approach has played a pivotal role in Jhunjhunwala's success, showcasing the power of strategic investing in generating substantial wealth over time.

Source: DSP, Company Financials as on May 2023

“Don't mistake a bull market for brilliance.” - Ray Dalio

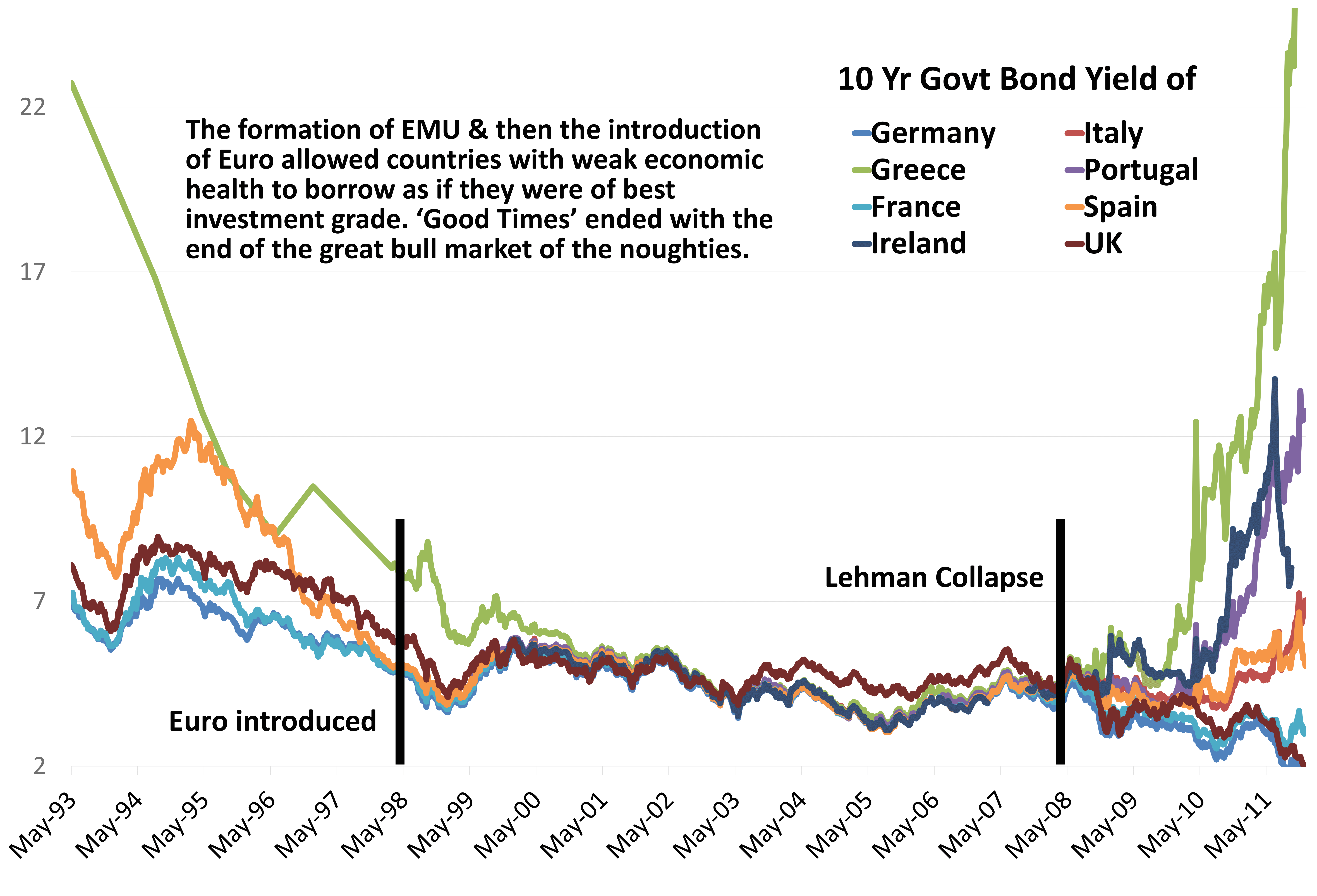

The European debt crisis started as a small local policy shock in Greece in the late 2000s and, by 2010, had morphed into a crisis that threatened the stability of the Euro.

One of the primary drivers of the Sovereign debt crisis in the EU was the bull market induced convergence of spreads. Countries with poor growth, high indebtedness, and a high unemployment rate enjoyed ultra-low borrowing costs on the back of stronger EU members like Germany. This divergence in underlying vulnerabilities was exposed by the end of the great bull market of the noughties.

Ray Dalio’s Bridgewater Associates took bearish positions on the debt of several European countries that were severely affected by the crisis, such as Greece, Ireland, Portugal, Spain, and Italy. They believed these countries faced significant financial challenges and potential default risks.

Source: DSP, Bloomberg, Data as on May 2023

“When others conduct their affairs with excessive negativism, it’s worth being positive.” - Howard Marks

The Recession Buy Indicator (RBI) was created by Norman Fosback, who for several years starting the 1970s was President of the Institute for Econometric Research. In the May 8, 2008 issue of his newsletter Fosback’s Fund Forecaster, (no longer published), he reported that the RBI had an “incredibly accurate” record.

The RBI is not foolproof. By definition, the indicator will be premature when recessions are much longer than average. During the Global Financial Crisis, for instance, the RBI was triggered in mid-2008, nine months before the stock market actually bottomed.

RBI has been right more often than not. The broader implication of its success is that the time to buy is when the news is all, or even mostly, all bad. If you wait until the news is good, you will miss out on much of the stock market’s subsequent recovery. As Fosback wrote in 2008: “If it’s a recession… Buy!”

- Mark Hulbert

Source: DSP, Norman Fosback, Hulbert Ratings, Marketwatch, as on May 2023

“The only article Lady Fortuna has no control over is your behavior. Good luck.” - Taleb

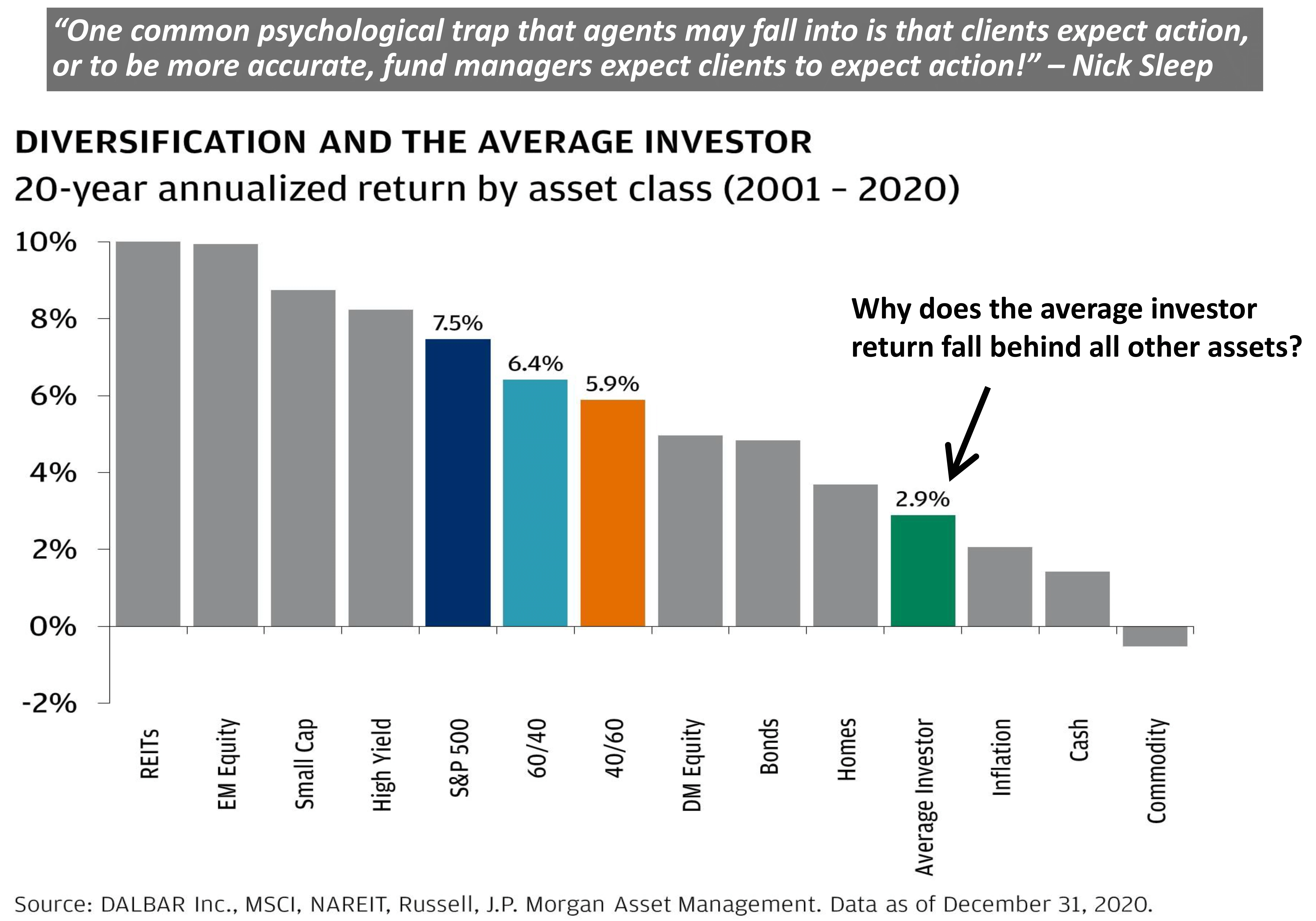

"The grim irony of investing is that we investors as a group not only don't get what we pay for, we get precisely what we don't pay for."– Jack Bogle

If investors were ever to have an anti-anthem, it could be this: "It’s no surprise to me, I am my own worst enemy.“

Chasing performance, chasing the fanciest investment idea, diversifying too much or too little, panicking at the worst possible time... The list is endless. The pitfalls are too many. The only sanity check for investors is to stay for the long term, not overpay, and not do anything stupid.

Source: JP Morgan, DALBAR Inc, DSP.

“Don’t look for a needle in the haystack, just buy the haystack” - Jack Bogle

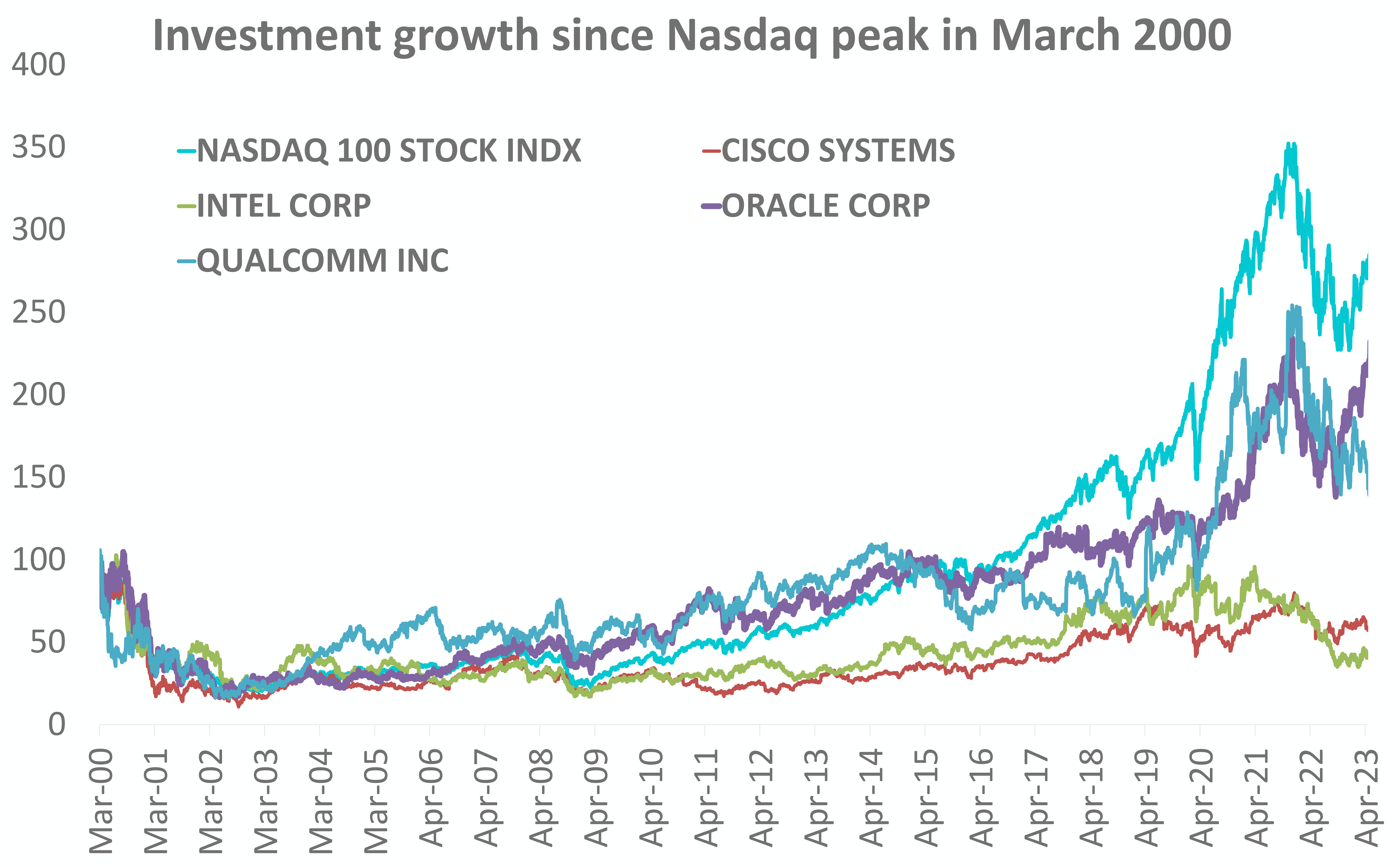

Investors often seek that one exceptional stock within the vast expanse of the market, hoping it will bring success. Jack Bogle, the visionary founder of the Vanguard Group & pioneer of index funds, wisely advised, “Don't look for a needle in the haystack, just buy the haystack."

Although Bogle shared this wisdom back in the 1970s, its relevance endures even today. It resonates with us as a reminder of the merits of investing in the entire index rather than fixating on individual stocks.

Consider the performance of some leading Nasdaq 100 companies vs the index itself. From the top 10 companies in the index back in 2000, 4 have under performed the index, 5 are no longer part of the index.

If an investor had chosen to invest solely in these companies, given their significant weightage within the index, it may not have been the best decision. It is likely that they would have generated lower returns than if they had invested in the entire index itself.

By heeding Bogle's advice and embracing the "haystack" of the index, investors can position themselves for more consistent and rewarding investment outcomes.

Source: Parth Shah, DSP, Bloomberg, Data as on May 2023

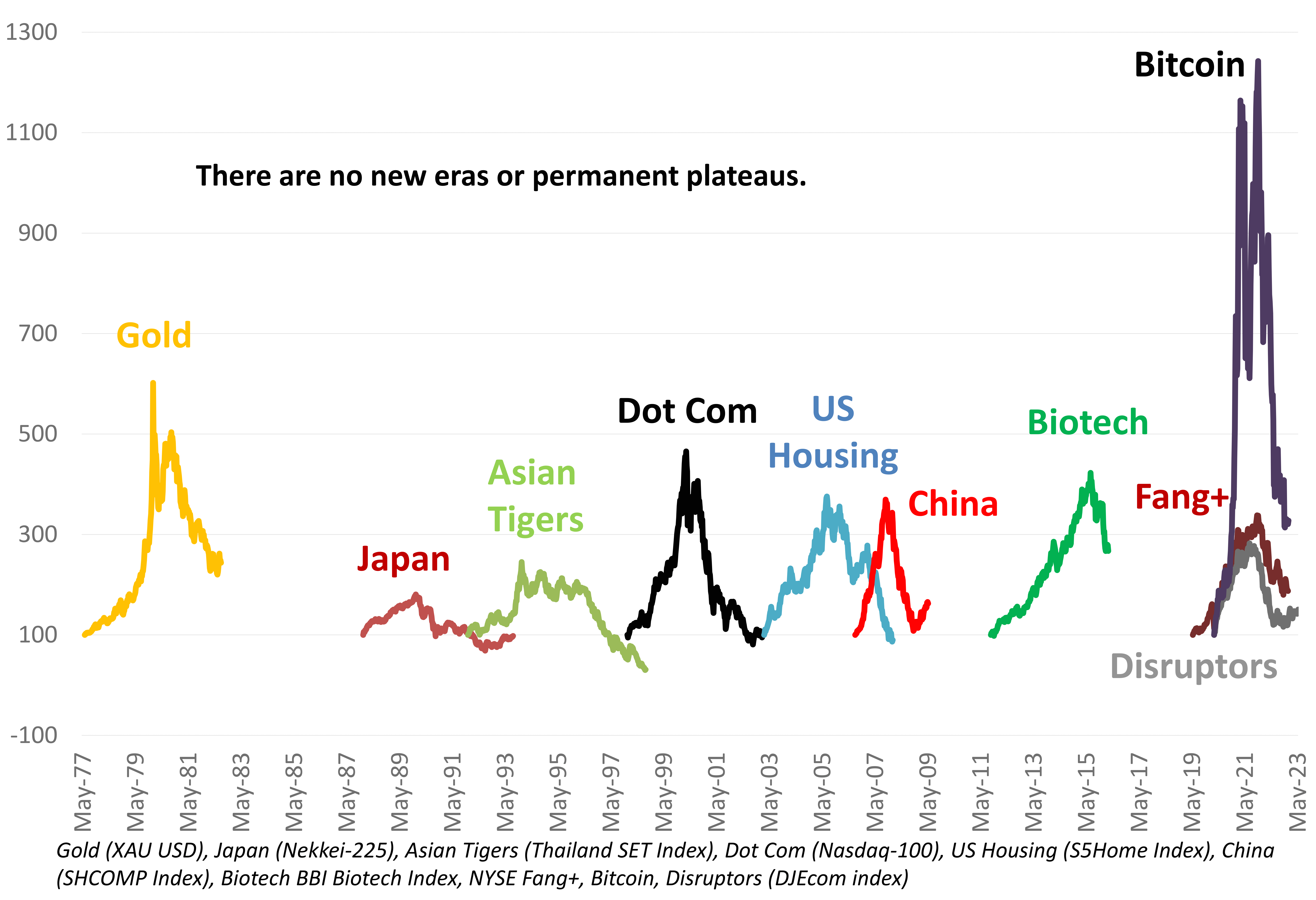

“The four most dangerous words in investing are: 'This time it's different.’” - John Templeton

Every single time it actually feelslike: ‘This time it’s different’. But it never is.

Financial bubbles and busts continue to resurface due to a confluence of psychological, economic, and systemic factors. Deeply rooted in human nature, these phenomena are fueled by herd behavior, irrational exuberance, and a potent cocktail of greed, fear of missing out, and unwarranted confidence.

Beyond the influence of human psychology, economic conditions contribute to the persistence of these cycles. Easy credit, low interest rates, and speculative fervor serve as catalysts, igniting and perpetuating the speculative mania. As a result, financial markets become vulnerable to distorted valuations and excessive risk-taking, paving the way for a subsequent collapse.

Trust experts, yet ask questions. Do we deserve ‘Different’ times? Most often the answer is “No.”

Source: DSP, Bloomberg, Data as on May 2023

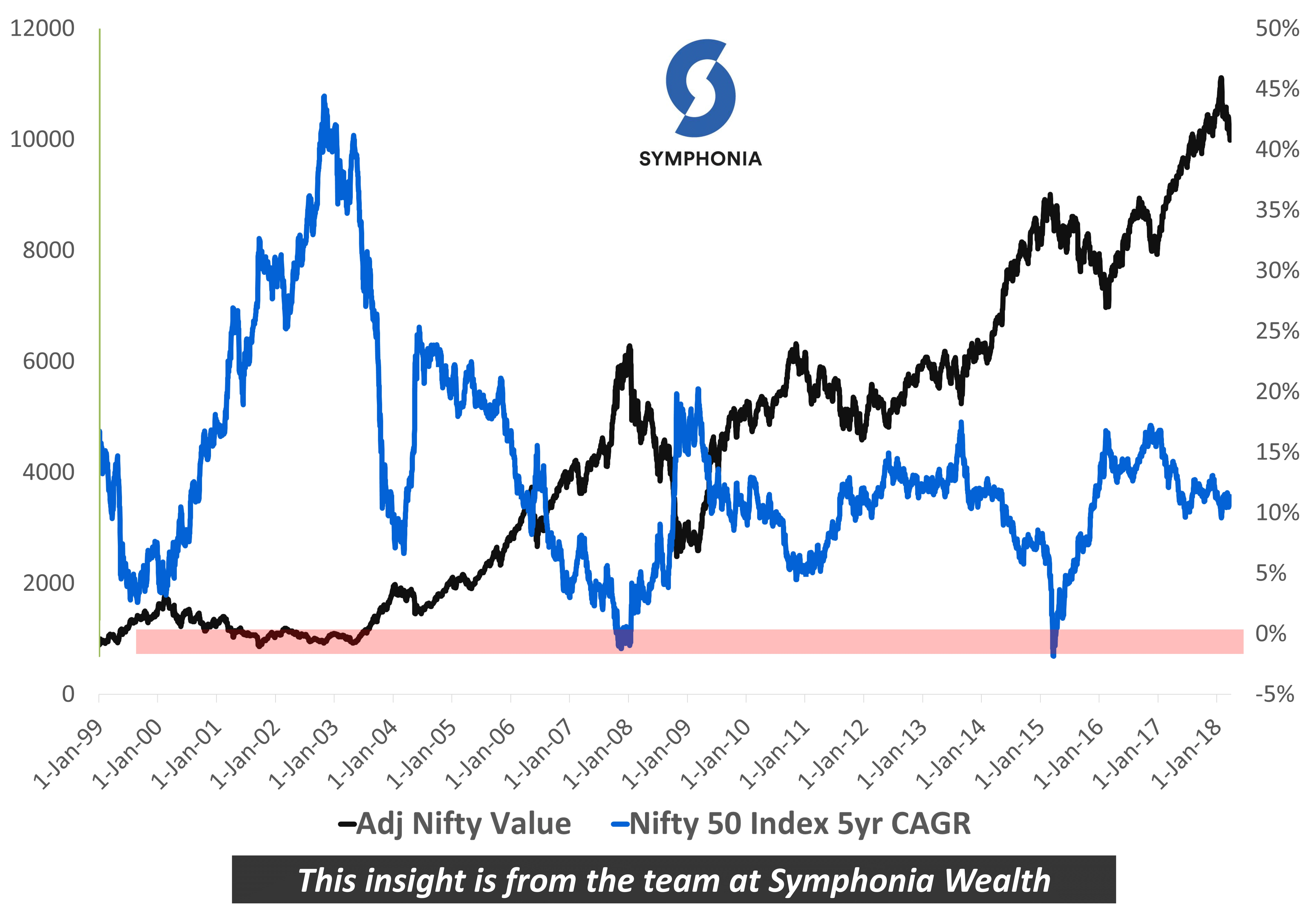

“There are three ingredients for success – aggressiveness, timing and skill – and if you have enough aggressiveness at the right time, you don't need that much skill.” – Howard Marks

What Howard Marks said is closely achieved by our very own SIP; its inherent model makes it aggressive at the right time because it can buy more units for the same money when markets are down & vice versa. Here is a 20-year Nifty Index outcome for this. If we analyze the 5-year return on daily rolling for SIP instalments done in Nifty from Jan 1, 1999, to Mar 31, 2023, we get data points till Mar 31, 2018, where these instalments have completed 5 years. If an investor had hypothetically made a daily SIP in the Nifty since Jan 1, 1999, the blue line would have represented the individual returns for each SIP installment.

Between Jan 1, 1999 & Mar 31, 2023, there were 7,030 observations that completed a tenure of 5 years, but their CAGRs were not the same. During this period, the minimum return for any 5-year SIP installment in Nifty was -1.8%, while the maximum return was +44.4%..

Upon examining the graph, it becomes apparent that whenever the Nifty index rises, the 5-year CAGR on the corresponding instalments tends to decrease, while during periods of Nifty decline, the 5-year CAGR on those instalments typically increases.

Source: Symphonia Wealth

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us