96.25 lakh people have invested in this fund

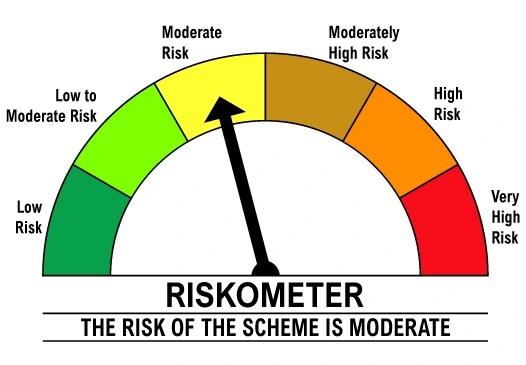

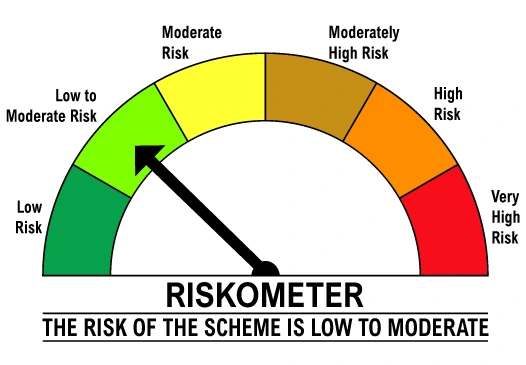

This solution is created with the aim of generating returns at relatively lower risk. With 75% of your principal allocated towards fixed income securities, it shall contain any adverse impact even in highly volatile political & economic environment. The 25% allocation to equity scheme is with an aim to enable your investment to beat the rate of inflation.

Risk factor:

Very High Risk

50%

Share

Risk factor:

Very High Risk

25%

Share

Risk factor:

Very High Risk

15%

Share

Risk factor:

Very High Risk

10%

Share

Risk

Occasional ups & downs

Goal of Investment

Earn returns that beat inflation

Ideal holding period

3 years

10 years

5 years

3 years

1 year

Rohit Singhania

Karan Mundhra

Shantanu Godambe

Shalini Vasanta

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Solution Description

This solution is created with the aim of generating returns at relatively lower risk. With 75% of your principal allocated towards fixed income securities, it shall contain any adverse impact even in highly volatile political & economic environment. The 25% allocation to equity scheme is with an aim to enable your investment to beat the rate of inflation.

₹ 500 Lumpsum

₹ 500 SIP - 12 instalments

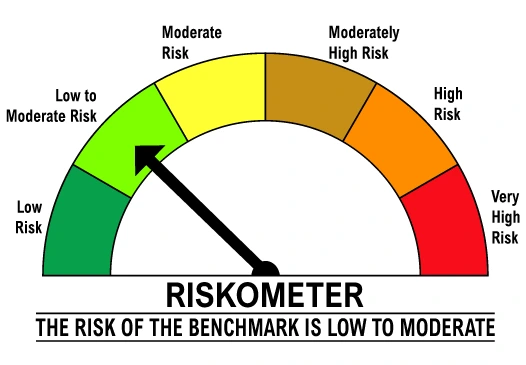

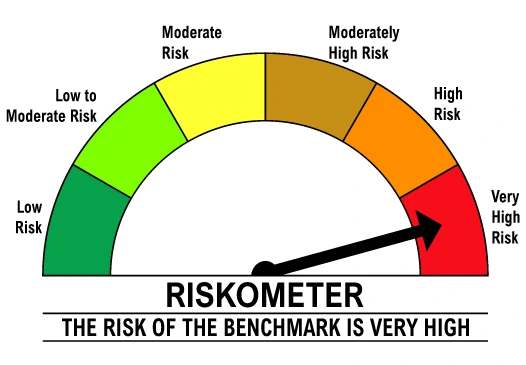

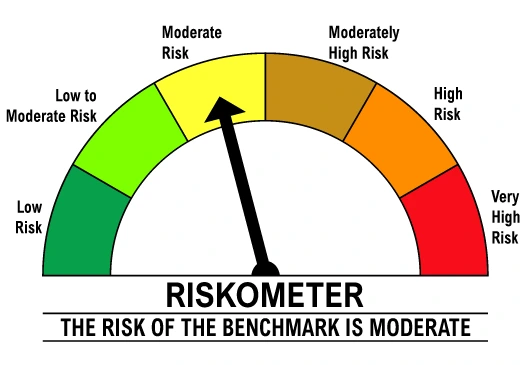

Benchmark of DSP Equity Opportunities Fund

Benchmark of DSP Short Term Fund

Benchmark of DSP Ultra Short Fund