31.32K people have invested in this fund

31.32K people have invested

in this fund as of

Total AUM

₹2,517.21 crores

as of Mar 31, 2025

Age of Fund

9 years 28 days since Mar 28, 2016

Expense Ratio

1.26%

as of Apr 24, 2025

Exit Load

NIL

Ideal holding period

5 Years+

| Large Cap | 83.6% |

| Mid Cap | 6.2% |

| Small Cap | 10.2% |

| Holdings | Weight % |

|---|---|

| HDFC Bank Limited | 3.6 % |

| ICICI Bank Limited | 3.2 % |

| Kotak Mahindra Bank Limited | 2.2 % |

| Axis Bank Limited | 1.8 % |

| Cipla Limited | 1.7 % |

| NTPC Limited | 1.7 % |

| ITC Limited | 1.7 % |

| SBI Life Insurance Company Limited | 1.7 % |

| Mahindra & Mahindra Limited | 1.7 % |

| Samvardhana Motherson International Limited | 1.3 % |

| View All | 31.2 % |

| Credit rating profile | Weight % |

|---|---|

| SOV | 52.7 % |

| Cash & Equivalent | 3.9 % |

| AA+ | 3.7 % |

| AAA | 22.3 % |

| A1+ | 17.3 % |

| Instrument break-up | Weight % |

|---|---|

| Government Securities (Central/State) | 52.7 % |

| TREPS | 3.9 % |

| Bonds & NCDs | 26.1 % |

| Money market instruments | 17.3 % |

| Holdings | Weight % |

|---|---|

| 7.38% GOI 2027 | 2.7 % |

| 7.11% Maharashtra SDL 2038 | 2.5 % |

| Power Finance Corporation Limited | 2.0 % |

| HDFC Bank Limited | 1.9 % |

| 7.09% GOI 2054 | 1.4 % |

| 8.51% GOI FRB 2033 | 1.4 % |

| Cash & cash equivalents | 1.4 % |

| 7.34% GOI 2064 | 1.3 % |

| TREPS / Reverse Repo Investments | 1.1 % |

| HDFC Bank Limited | 1.1 % |

| View All | 29.0 % |

| Holdings | Weight % |

|---|---|

| Brookfield India Real Estate | 1.5 % |

| Indus Infra Trust | 1.4 % |

| NIFTY 23000 Put Apr25 | 0.1 % |

| 3.0 % |

| Holdings | Weight % |

|---|---|

| Arbitrage Holdings | 36.8 % |

Yield to Maturity

7.08 %

Modified Duration

3.76 Years

Portfolio Macaulay Duration

3.91 Years

Average Maturity

7.40 Years

Portfolio turnover ratio

5.40 last 12 months

Portfolio turnover ratio - Directional Equity

0.13 last 12 months

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | Nifty Equity Savings Index ^ | CRISIL 10 Year Gilt In… # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Click here to view the information ratio of the scheme.

Date of allotment: Mar 28, 2016.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Abhishek Singh

Kaivalya Nadkarni

Shantanu Godambe

The investment objective of the Scheme is to generate income through investments in fixed income securities and using arbitrage and other derivative Strategies. The Scheme also intends to generate long-term capital appreciation by investing a portion of the Scheme's assets in equity and equity related instruments.

However, there can be no assurance that the investment objective of the scheme will be realized.

An open ended scheme investing in equity, arbitrage and debt

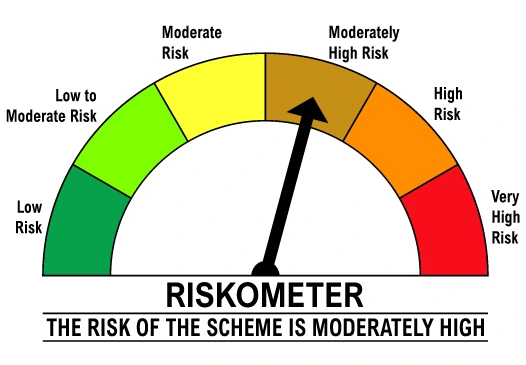

Level of Risk in the fund

There are two major ways to invest in the DSP Equity Savings Fund, (a) first is through the DSP Mutual Fund's website, (b) second is to invest through a SEBI registered market intermediary, such as zero commission mutual fund platforms, using its app or website. Before making the investment, it is pertinent to understand that most mutual funds including DSP Equity Savings Fund have two plans of the mutual fund scheme. The two plans are (a) the direct plan and (b) the regular plan. You can invest in the direct plan of the DSP Equity Savings Fund through (a) zero brokerage platforms or (b) through the website of the DSP Mutual Fund. If you are investing in the direct plan from a no brokerage app/web platform, the exact name of the mutual funds scheme which you search for is DSP Equity Savings Fund Direct Plan - Growth Option.

Any investor can redeem its mutual funds units of DSP Equity Savings Fund by following the below-mentioned steps:

(a) login into investment platform from where you made the investment: Login into your investment account with your investment app/website using your login credentials. Investment app/website will be the platform through which you made the investment in DSP Equity Savings Fund initially. It may be DSP Mutual Fund's website or a mobile app or a brokerage firm's website;

(b) find your mutual fund units: Typically, your investment platform will list all the mutual fund investments you have made through that particular platform. Locate the DSP Equity Savings Fund in your portfolio;

(c) initiate redemption: select the "Redeem" or "Sell" option of your DSP Equity Saving Fund units;

(d) enter redemption details: enter the number of mutual fund units you wish to redeem or in the alternative the amount you intend to withdraw;

(e) confirm details: review the redemption details and confirm your redemption request by clicking "redeem" or "ok" button;

(f) await confirmation: typically investor's redemption request will be registered immediately within the system and a confirmation message will pop up. The time for processing transfer of funds may vary depending on the investment platform and market conditions;

(g) receipt of funds: once the redemption request is processed by the mutual fund house, the funds will be credited to the bank account linked to your investment platform.

The expense ratio is an annual fee charged by the mutual fund house, to the investors investing in a particular mutual fund scheme (expense ratio is subject to change in future depending on various factors). It is a fee charged by the mutual fund house in exchange of providing the investment service by the mutual fund house. It covers operational expenses as well as management expenses of the mutual fund house. Mutual fund schemes have two plans: regular and direct. The direct plan of any mutual fund scheme has a lower expense ratio when compared with the regular plan of the same mutual fund scheme. Generally, regular plan have a higher expense ratio than the direct plan because typically they are sold/distributed through a SEBI registered intermediary, i.e., a mutual fund distributor. A higher expense ratio for regular plan is required in order to ensure that the mutual fund distributor is also compensated adequately for distributing/selling the mutual fund scheme.

An Equity Savings Fund is a type of Hybrid Mutual Fund that invests in both equity and debt securities. Within Hybrid Funds, there are several sub-categories, including Conservative Hybrid, Balanced Hybrid, Aggressive Hybrid, Dynamic Asset Allocation, Multi-Asset Allocation, Arbitrage, and Equity Savings Funds.

Equity Savings Funds are designed to provide a balanced approach by allocating a significant portion of their assets to equities, while also investing in debt securities for added stability. With a focus on both growth and lower volatility, these funds aim to offer capital appreciation while managing risk. Additionally, they may engage in arbitrage to enhance returns.

As stated previously mutual funds are subject to market risk and there are no guarantees in relation to returns. However, it is important to note that the DSP Equity Savings Fund has a diversified investment strategy, it invests in equity, debt and undertakes arbitrage too. A well-diversified investment strategy has potential to provide returns with lower volatility. Especially during times of higher market volatility, hybrid mutual funds like DSP Equity Savings Fund can help investors manage the risk associated with their portfolio optimally.

31.32K peoplehave invested in this fund as of