Total AUM

₹572.91 crores as of Mar 31, 2025

Age of Fund

7 months since Sep 05, 2024

Expense Ratio

0.15%

as of Apr 24, 2025

Exit Load

Nil

Goal of Investment

Capital Growth & Income

Ideal holding period

10 Years+

| Large Cap | 100.0% |

| Top Holdings | Weight % |

|---|---|

| Larsen & Toubro Limited | 10.12 % |

| ICICI Bank Limited | 10.09 % |

| HDFC Bank Limited | 10.09 % |

| Bharti Airtel Limited | 10.07 % |

| Kotak Mahindra Bank Limited | 10.06 % |

| ITC Limited | 10.05 % |

| Reliance Industries Limited | 9.97 % |

| Axis Bank Limited | 9.91 % |

| Tata Consultancy Services Limited | 9.91 % |

| Infosys Limited | 9.70 % |

| 99.97 % |

| Credit rating profile | Weight % |

|---|---|

| Cash & Equivalent | 100.0 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 100.0 % |

| Top Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 0.61 % |

| Cash & cash equivalents | -0.58 % |

| 0.03 % |

Portfolio turnover ratio

0.11 last 12 months

Tracking Error

0.07 %

Tracking Error (Abs.)

0.004 %

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | NIFTY TOP 10 EQUAL WEIGHT TRI ^ | NIFTY 50 TRI # | Tracking difference | |||||

|---|---|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |||

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

Anil Ghelani

Diipesh Shah

The Scheme seeks to provide returns that, before expenses, correspond to the total return of the underlying index (Nifty Top 10 Equal Weight TRI), subject to tracking errors.

There is no assurance that the investment objective of the Scheme will be achieved.

An open ended scheme replicating/ tracking Nifty Top 10 Equal Weight Index

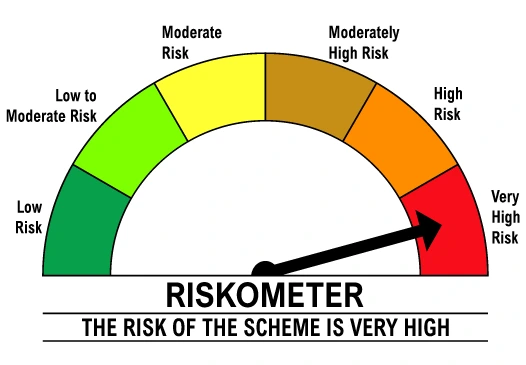

Level of Risk in the Scheme

Other Information