4.54 lakh people have invested in this fund

4.54 lakh people have invested

in this fund as of

Total AUM

₹11,154.06 crores

as of Mar 31, 2025

Age of Fund

27 years 11 months since Apr 29, 1997

Expense Ratio

1.74%

as of Apr 15, 2025

Exit Load

1%

upto 12 Months

Ideal holding period

10 Years+

Top holdings

Bajaj Finance Limited

7.83%

ICICI Bank Limited

6.42%

HDFC Bank Limited

5.32%

Axis Bank Limited

4.17%

Coforge Limited

2.88%

Allocation by Market Cap

Large Cap

61.00%

Mid Cap

21.50%

Small Cap

17.90%

Top Sectors

Banks

Finance

It - Software

Pharmaceuticals & Biotechnology

Auto Components

Top holdings

No Data to display

Top holdings

TREPS / Reverse Repo Investments

3.81%

Cash & cash equivalents

0.56%

Instrument break-up

TREPS

100.00%

Portfolio turnover ratio

0.25 last 12 months

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | NIFTY 500 TRI ^ | NIFTY 50 TRI # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Click here to view the information ratio of the scheme.

Date of allotment: Apr 29, 1997.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Bhavin Gandhi

The primary investment objective of the Scheme is to seek to generate long term capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of issuers domiciled in India. This shall be the fundamental attribute of the Scheme.

There is no assurance that the investment objective of the Scheme will be realized.

An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks.

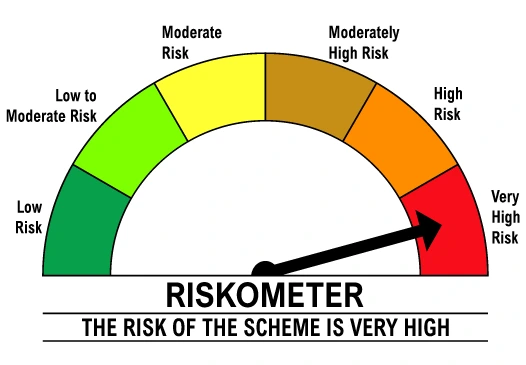

Level of Risk in the fund

A flexi cap fund is a type of an equity mutual fund that has the flexibility of investing across different market capitalization segments. Unlike funds with market cap mandates, such as large-cap or mid-cap funds or large and midcap funds, flexi-cap funds can invest dynamically across all the three market cap segments based on the fund manager's outlook and prevailing market conditions. DSP Flexi Cap fund invests flexibly across carefully selected companies of different sizes- large, mid, or small.

To invest in the DSP Flexi Cap fund, click on the green INVEST button on the left-hand side of the webpage (Click here). If you are an existing DSP Mutual Fund investor, you can start investing immediately. If you are new to DSP Mutual Funds, you will need to create a portfolio by filling out the necessary details. If you are new to mutual Funds, you will have to fulfill KYC requirements. Follow the on-screen instructions to get started. You can also invest in DSP Flexi Cap Fund through your mutual fund distributor.

Returns of DSP Flexicap Fund will depend on prevailing market conditions and investment horizon. Historical data shows that equity as an asset class, has the potential to outperform other asset classes over a long investment horizon. DSP Flexicap Fund has the potential to outperform large cap funds over long investment tenures. At the same, it can limit downside risks compared to mid-cap and small-cap funds in volatile markets.

Investors can check the past performance of DSP Flexicap Fund by clicking on the (performance) section. You can can check both lump sum and SIP returns. We have shown how DSP Flexicap Fund has performed versus its benchmark index (Nifty 500 TRI) and its additional benchmark (Nifty 50 TRI) over the last 1, 3, 5 years and since inception. One should always evaluate an equity fund?s performance over long investment periods.

Ideal for retail investors: Flexi cap funds are ideal for investors who are not able to decide how much allocation they should have towards each market cap segment and want the fund managers to decide on market cap allocations. Flexi cap fund managers aim for long-term capital appreciation while trying to limit downside risks in the short term. Hence, flexi cap funds can be part of the core equity portfolio of investors.

Before investing in the DSP Flexi Cap fund, one should consider the following factors to ensure alignment with your financial goals and risk tolerance:

Financial Goals: What is the financial goal for investing in DSP Flexi Cap Fund? Is the objective capital appreciation or income generation? Is the goal short term, medium term or long term?

Investment Objective: DSP Flexicap Fund is suitable for investors seeking capital appreciation over long investment tenures

Investment tenure: Investors should have minimum 5 year investment tenure for DSP Flexicap Fund.

Risk Appetite: Investors should assess their risk appetite and make informed investment decisions. Investors should have high to very high risk appetites for DSP Flexicap Fund.

Financial situation: Investors can invest in DSP Flexicap Fund either in lump sum or through a Systematic Investment Plan.

Investors should consult with their financial advisors or mutual fund distributors if DSP Flexicap Fund is suitable for their investment needs.

Flexicap equity mutual funds generally have a higher level of risk compared to large-cap funds since they invest in midcap and small cap stocks in addition to large cap stocks. Mid-sized and small cap companies, while often having significantly higher growth potential than large companies, may also be more vulnerable to economic downturns due to their smaller size. Furthermore, the valuations of midcap and small cap companies tend to run up faster than large caps, and hence they can experience deeper price corrections in volatile markets. However, the risk profile of flexi cap funds is lower (less volatile) than midcap, small cap or multicap funds since they have the flexibility of increasing their large cap allocations in highly volatile markets. Investors should high to very high risk appetites for Flexicap Funds. Investors should carefully assess their risk tolerance, investment goals, and time horizon to make informed investment allocation decisions. Investors should consult with their financial advisors if they need help in understanding their risk appetite and risk characteristics of the mutual fund scheme they plan to invest in.

4.54 lakh peoplehave invested in this fund as of