3.06K people have invested in this fund

3.06K people have invested

in this fund as of

Total AUM

₹11.27 crores

as of Mar 31, 2025

Age of Fund

2 months since Feb 14, 2025

Expense Ratio

1.01%

as of Apr 17, 2025

Exit Load

Nil

Ideal holding period

10 Years+

Top holdings

HDFC Bank Limited

21.05%

ICICI Bank Limited

21.04%

Kotak Mahindra Bank Limited

19.23%

Axis Bank Limited

18.94%

The Federal Bank Limited

4.79%

Allocation by Market Cap

Large Cap

81.70%

Mid Cap

16.10%

Small Cap

2.40%

Top Sectors

Banks

Top holdings

No Data to display

Top holdings

TREPS / Reverse Repo Investments

3.58%

Cash & cash equivalents

-1.93%

Instrument break-up

TREPS

100.00%

Portfolio turnover ratio

0.09 last 12 months

Tracking Error

0.26 %

Tracking Error (Abs.)

0.016 %

Note:Under SEBI regulations, the performance of this fund can’t be displayed as it has been in existence for less than 6 months.

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Anil Ghelani

Diipesh Shah

The investment objective of the Scheme is to generate returns that are commensurate with the performance of the Nifty Private Bank Index, subject to tracking error.

There is no assurance that the investment objective of the Scheme will be achieved.

An open-ended scheme replicating / tracking Nifty Private Bank Index.

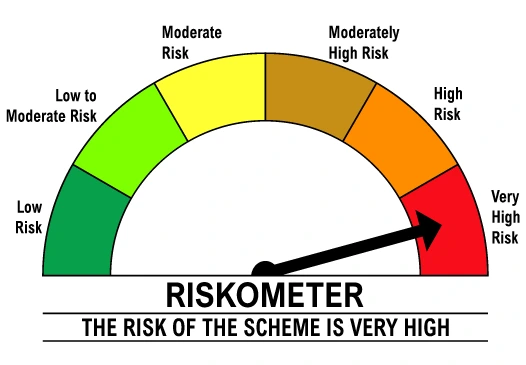

Level of Risk in the fund

3.06K peoplehave invested in this fund as of