How debt funds save your tax outgo?

If you replace your Fixed Deposits that have a tenure of at least 3 years with Debt Funds, then your tax outgo on returns earned goes down from 30% to just 8.4%!

Debt Funds vs. Fixed Deposits: Compare the post-tax returns

Select rate of return

Select investment amount

Investment in Fixed Deposits

would have grown to

₹ ?

vs.

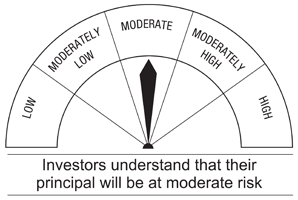

Investment in Debt Funds

would have grown to

₹

This calculation is based on holding period of 3 years. If you stay invested for longer duration, the tax benefit increases further.