Dear Mom and Dad,

So here is a possible solution that I was referring to:

DSP Equity Savings Fund

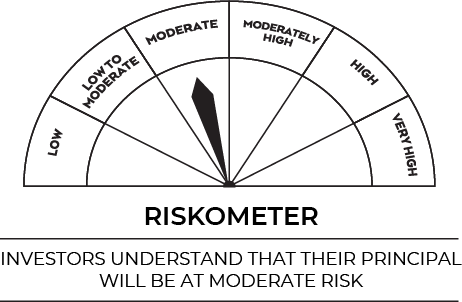

This is a hybrid fund that presents a possible growth opportunity along with relatively better stability. It keeps you geared up for gains, through its equity allocation, while providing a shield for volatility, through debt, to help ease your risk-taking ability.

It aims to prevent you from major element of surprise with relatively more predictable outcomes with investment in bonds, arbitrage, debt, as well as equity.

With asset allocation in fixed income securities, the potential returns can be moderate but so will be the risk. However, in the long run, its fair share of equity asset allocation also provides good potential for wealth creation.

So, let's use this fund to start investment practices which we couldn't in the past.