Perfection, Automated.

Equal NIFTY 50 Fund automates 3 key tasks with an aim to deliver a perfect investment solution for sustainable returns at reasonable risk.

Automates where to invest

Ensures you are always invested in #PerfectPachas. No deviations.

Automates how much to invest

Allocates ~2% each to the #PerfectPachas companies. No favorites. No biases.

Automates diversification, smartly

Equal allocation minimizes risk from any over-exposure while ensuring you don’t miss out investing in emerging sectors.

Perfect for any pocket

Don’t burn a hole in your pocket to invest in all 50 stocks. Invest partially in each of #PerfectPachas stocks & bring down the total amount needed.

To buy 1 share each of the #PerfectPachas, you would need:

₹1.32 lakh + brokerage

To buy #PerfectPachas stocks with 2% allocation to each, you would need:

₹7.28 lakh + brokerage

With DSP Equal NIFTY 50 Fund, you can begin with:

As low as ₹1,000 as Lumpsum or even ₹500 p.m. through SIP

All about the fund

Simple. Affordable. Automated. Commitment-free

Only invests in India’s top 50 companies

These are large companies that drive India forward. Their size ensures relatively less volatile business performance.

Follows rule-based investing methodology

The #PerfectPachas stocks are identified based on their inclusion in NIFTY 50 Index. Rules to follow also include investing & retaining equal allocation.

Built to buy low & sell high

To retain equal allocation in #PerfectPachas, the fund books profits in stocks that have run up. And simultaneously buys more of stocks that have corrected.

Allows commitment-free investment

The fund doesn’t levy exit load. Withdraw anytime you want.

FEATURED ARTICLES

For more information, call 1800-200-4499 or write to [email protected].

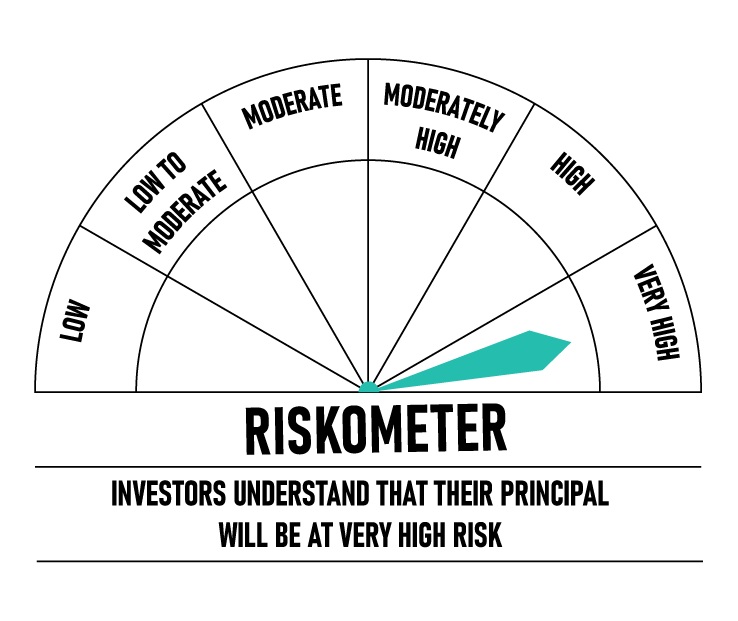

DSP Equal NIFTY 50 Fund (An open ended scheme replicating NIFTY 50 Equal Weight Index)

- Long-term capital growth

- Returns that are commensurate with the performance of NIFTY 50 Equal Weight Index, subject to tracking error