Summary

Find out why you might want to consider tilting your portfolio towards large-caps at this point.

Indian retail investors are not a happy bunch right now.

After having hit an all-time high of 26,277 in September 2024, the Nifty50 stood at 23,344 as of 20 January 2024: a fall of around 11%.

Why? A whole host of factors are responsible, including selling by foreign institutional investors (FIIs), rising US treasury yields, a falling rupee, projections of slower domestic GDP growth, lacklustre earnings expectations, and unjustifiably high valuations.

At such times of uncertainty, when fear reigns supreme and the path forward isn’t clear, investors need to lick their wounds and plan their next steps carefully.

Should they continue chasing the thematic / sectoral / small-cap / mid-cap rainbows, or does it make more sense to fall back on the familiar strength of large-caps?

Here’s some wisdom that might help.

Let’s start with a fundamental idea: ultimately, the market is cyclical. So usually, what rises fast eventually reverts to the mean, and vice versa. Until recently, small- and mid-caps were outperforming, which means that it might now be time for large-caps to shine.

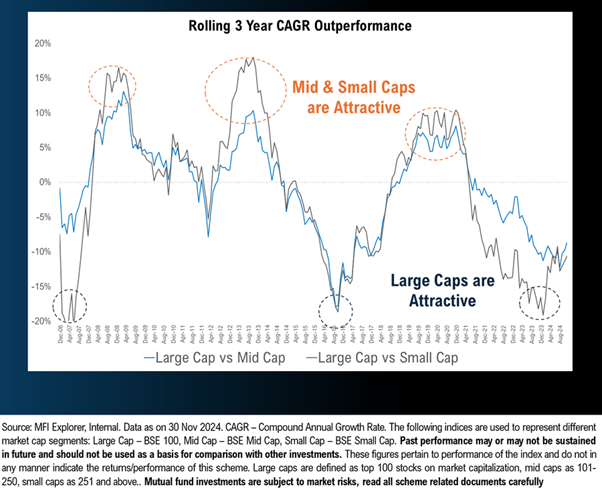

Here’s some data that points in this direction: consider the chart below, which tracks the outperformance of large-caps vs. mid-caps and of large-caps vs. small-caps (in terms of their rolling 3-year CAGRs).

The cyclical nature of the market is quite evident here. Periods of large-cap outperformance (i.e. peaks) are followed by periods of small- and mid-cap outperformance (i.e. bottoms).

Now, we can see that small- and mid-caps have done especially well in the last 2-3 years. To bring in some numbers here: over the last 3 years, the CAGR of the BSE 100 Index (which includes only large-caps) has been around 14%, while that of the BSE MidSmallCap Index has been around 24%.

Thus, over the last 3 years, large caps have posted a rather significant level of underperformance compared to small and mid caps. This suggests that large-cap outperformance is likely to return over the next few years.

As a result, it’s hardly surprising that several prominent market experts have now begun pointing out the advantages of large-caps over small- and mid-caps:

Nifty Top 10 Equal Weight Index recoups between 1.2% to 2.5% alpha against all broad indices in a day.

— Sahil Kapoor (@SahilKapoor) January 10, 2025

It has also fallen the least from the 52wk high.

Just getting started. #Largest pic.twitter.com/QDdeD0lSzj

Will such a move make sense for you? Well, that depends on the details of your portfolio’s current allocations. If you’d like a deeper understanding of how you can best invest in large caps right now, make sure to watch this conversation with Anil Ghelani, DSP’s Head of Passive Investments & Products.

If you’d like to learn more about how you can adapt to market changes, or if you need help with any aspect of the investing process, simply click here to reach out to our experts.

Industry insights you wouldn't want to miss out on.

Disclaimer

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the schemes of DSP mutual fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). Data provided is as on Dec 31st, 2024 (unless otherwise specified). The figures pertain to performance of the index and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index. All logos used in the image are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them. Large caps are defined as top 100 stocks on market capitalization, mid caps as 101-250, small caps as 251 and above. All opinions, figures, charts/graphs and data included in this document are as on date and are subject to change without notice. For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, Statement of Additional Information and Key Information Memorandum of the scheme available on ISC of AMC and also available on www.dspim.com. There is no assurance of any returns/capital protection/capital guarantee to the investors in above mentioned Scheme. The document indicates the strategy/investment approach proposed to be followed by the above mentioned Scheme and the same may change in future depending on market conditions and other factors.

Other Blogs

Sort by

Write a comment