Summary

Find out why a multi-asset portfolio might be the key to creating generational wealth more smoothly.

Retail investors usually have access to four relatively liquid asset classes: domestic equity, international equity, debt, and gold. And depending on their risk appetite, it’s quite common for investors to have two or three preferred asset classes.

For instance, more adventurous folks might ignore gold and debt altogether, while retired investors might not be very interested in international equity.

In any case, a portfolio with holdings in all four asset classes is often perceived as being over-diversified, and thus spread too thin to generate significant returns.

But as with most things, the devil is in the details. It turns out that if you build a multi-asset portfolio with a rather conservative asset allocation and maintain it over the long term, you could generate equity-level, inflation-beating returns — with much less volatility than equities!

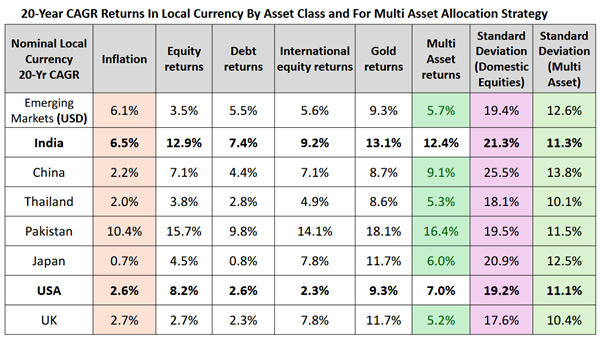

Don’t take our word for it: look at the data below.

Source: Bloomberg, DSP. Data as of Dec 2024. All returns are in local currency except for Emerging Market (USD). Multi Asset is based on Annual rebalancing and the weights are: Domestic Equity – 50%; Debt – 20%;

International Equity – 15%, Gold – 15%. Indices used For Equity: Emerging Markets (USD) – MSCI EM Index, India – Nifty 50, China – CSI300, Thailand – SET Index, Pakistan – KSE 100 Index, Japan – TOPIX, USA – S&P500, UK- FTSE 100 Index. For Debt, we have used: Emerging Markets (USD) – Bloomberg EM Sovereign Index, India – Crisil Short Term Bond, China - Bloomberg China Treasury, Thailand – Thai BMA Govt Bond Index, Pakistan - Bloomberg emerging fixed income – Pakistan, Japan - FTSE Japan Gov Bond, USA - Bloomberg US treasury bond index, UK - Bloomberg UK Gilt 1-5 year Index. International Equity for Emerging Markets (USD), India, Thailand, Pakistan, Japan, UK – MSCI ACWI and for China – MSCI ACWI ex China and for USA – MSCI ACWI ex US. Gold returns are in local currency except for Emerging Markets(USD).

As you can see, in all the markets under consideration, multi-asset returns either exceeded or came close to exceeding domestic equity returns in local currency terms over the last 20 years.

At the same time, the standard deviation (a measure of volatility) of multi-asset returns was significantly lower than that for domestic equity returns. The main reason for this is that usually, a period that is dismal for one asset class proves to be a good period for another asset class.

A final critical point to note is that over this 20-year period, gold outperformed equity markets in local currency terms across all markets.

Thus, it can be argued that multi-asset investing is not just another ho-hum strategy among many others — instead, perhaps it deserves to be the go-to strategy for portfolio management.

Indeed, it might be the most reliable way to create multi-generational wealth… if you can just manage to put up with the boredom!

One more monthly instalment in a boring fund (my SIP)

— Kalpen Parekh (@KalpenParekh) December 30, 2024

Boring as it owns 3 assets

- world and Indian stocks

- bonds of india

- gold & some silver

Generally these asset classes don’t do well at the same time

Hence, this fund will always own the poor performing asset class

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Check our Netra blogs for January 2025:

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of July 2024 (unless otherwise specified) and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Write a comment