Summary

In the last few years, the term premium has been very large. The short-term funds were earning much lower returns compared to a longer maturity. Since the yields either fell or remained stable, there were large returns in higher YTM funds

YTM kitna hai?

This seems the first and the last question before choosing a fund. It is time to revisit this decision.

Quite often, we choose funds based on YTM (Think of a bond's YTM as the total return that a buyer will receive, from the time the bond is purchased till the date the bond matures). We believe higher the YTM, more the returns. In a falling interest rate environment, higher YTMs do give better returns (even there not without risks) and looking at past performance can lull one into a false sense of security and prediction of future performance. Hence, it is important to look at the pitfalls in focusing on YTMs alone and we outline some risks to be aware of.

Methods to get higher YTM – and their risks

There are four ways that funds achieve higher YTM:

1. Increase duration – Increased interest rate risks:

Usually, the longer maturity debt instruments have higher yield. This is called as term premium. That is yields of 10 Year > 5 Year > 1 Year. But the higher maturity papers end up making larger losses if yields rise. Higher YTM funds do well in when rates fall or are stable, but lose money when rates rise. Across rate cycles, the returns should be similar.

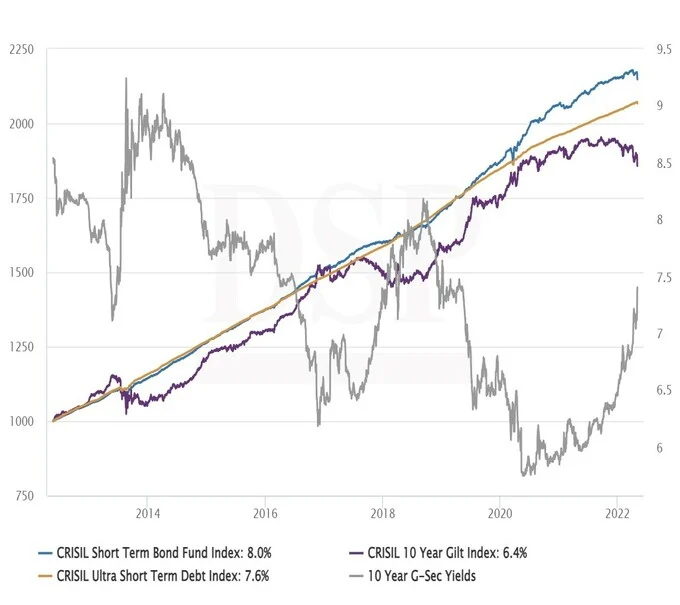

Returns across rate cycles: 10Y G-sec benchmark underperforms lower YTM benchmarks

In the last few years, the term premium has been very large. The short-term funds were earning much lower returns compared to a longer maturity. Since the yields either fell or remained stable, there were large returns in higher YTM funds (as they had longer duration).

Returns during falling rates: 10Y G-sec benchmark outperforms lower YTM benchmarks

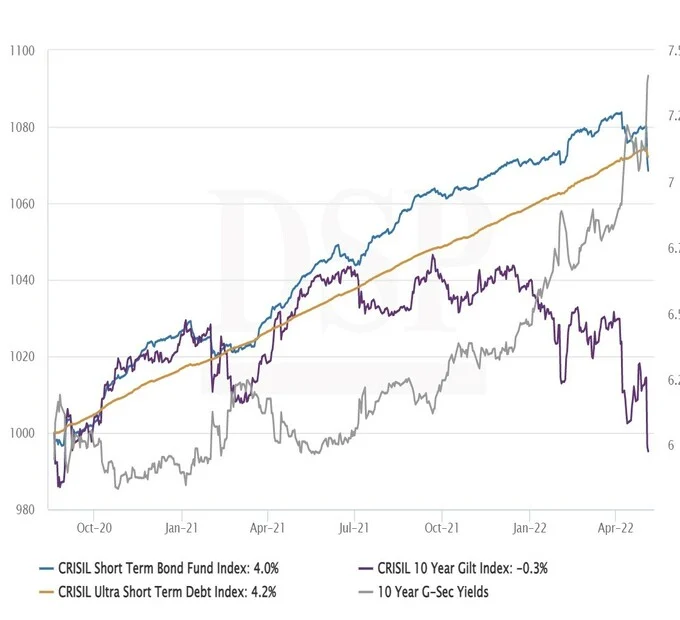

Returns during rising rates: 10Y G-sec benchmark underperforms lower YTM benchmarks

Based on the recency effect, there is a feeling prevalent that higher YTM gives higher returns. However, rate cycle has turned, and yield curve is rising. These higher YTM funds have started underperforming because duration is hurting (see chart above).

2. Credit risks – Increased default risk:

Usually, lower credit papers give higher YTM. That is yields of AA > AAA > G-secs. The higher return has default risk embedded. Funds with higher YTM due to credit risks can give higher returns if all goes well. But in the event of any eventuality like default / downgrade / illiquidity the excess returns can be eroded. Finally, over a longer time frame these funds could give similar returns to funds with low credit risk.

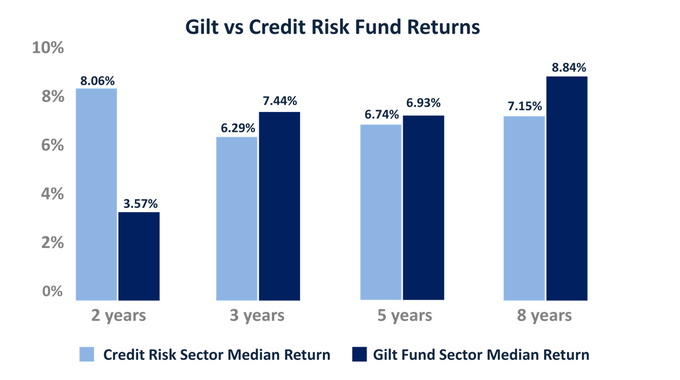

The chart 2 illustrates that the performance of credit risk funds and Government Securities (Gilt) funds is similar in long. There have been reduced credit events in past few years leading to recent outperformance run. This recency effect can lead investors to believe that higher YTM gives higher returns.

** Gilt vs Credit Risk Fund Returns**

Click to view in higher quality

Historically, credit spreads (and defaults) have increased during periods of tighter liquidity and higher rates.

With rates and liquidity worsening, investors need to be cognizant of the risks associated with higher YTM backed by higher credit.

3. Illiquidity risks – Increased volatility risk:

Some debt papers are less liquid. This can be because (i) they are less understood by investors, (ii) smaller investor base, (iii) infrequent issuers etc. The difference arises even among issuers with similar ratings - or among state loans (SDLs) from different states. Since these papers are not easy to sell, they demand higher YTM.

These instruments may give higher returns, but those returns would fall in cases when a market participant wants to sell these papers. In cases of redemptions the impact of returns can be large.

These risks are quite difficult to identify in funds as they cannot be ascertained purely by credit rating on maturity profile. If investors find two funds having similar maturity and credit profile but different YTM – they need to question whether the YTM is arising from liquidity risks.

4. Duration spread – Increased volatility risk:

Funds can achieve similar duration by combining different maturities. These combinations can have different YTM for similar duration. These strategies do not usually lead to large YTM differences, nor do they have longevity – and are usually tactical calls.

In recent times the duration risk, credit risk and illiquidity risk have worked well. However between 2016-2019 chase towards higher YTMs (through higher credit risks) led to eventual lower returns due to credit accidents across the industry. In the last couple of years, the chase for YTM coupled with past credit accidents led to a preference of higher duration products. With a sharp rise in yields this too ended up hurting the returns.

With rate cycle changing we all need to be wary of the risks associated to higher YTM products. Let not YTM be the only criteria to select funds.

To download this note in a PDF form, click here

Industry insights you wouldn't want to miss out on.

Disclaimer

This presentation is for information purposes only. In this material DSP Asset Managers Private Limited (the AMC) has used information that is publicly available. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All opinions, figures, charts/graphs and data included in this presentation are as on specific date and are subject to change without notice. There is no assurance of any returns/capital protection/capital guarantee to the investors in the Scheme. The presentation indicates the strategy/investment approach to be followed by the Scheme and the same may change in future depending on market conditions and other factors.

The distribution of this material in certain jurisdiction may be restricted or subject to registration requirements and, accordingly, persons who come in to possession of this material in such jurisdictions are required to inform themselves about, and to observe, any such restrictions.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, Statement of Additional Information and Key Information Memorandum of respective scheme available on ISC of AMC and also available on www.dspim.com

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  FAQs

FAQs Reach us

Reach us

Comments

Write a comment

Thank you!

Your comment has been received. We will review it and post it shortly after checking it.