Summary

All small-caps equally good? Or are there nuances that investors need to know about? Answering these questions is what this blog’s all about.

What does quality look like?

Small-cap companies that do well tend to have a few things in common: lower leverage, better profitability, operational efficiency, consistent earnings, a sound management team at the helm, and low(er) dependence on luck for good outcomes!

So if you’re evaluating a portfolio of small-cap stocks, ask questions for each stock that shed light on some or all of the above metrics, such as:

- Is the ROE (return on equity) more than 15%?

- Is the debt-equity ratio relatively low?

- Does the decision-making team have a good track record?

- Are earnings relatively consistent?

- Is the company’s market relatively large and/or expanding?

A ‘yes’ to all or most of these questions can be a good indicator of quality. But do you have the time or wherewithal to actually carry out such an analysis yourself?

With small-caps, pickiness is a virtue

On paper, the small-cap class as a whole looks quite attractive, especially these days.

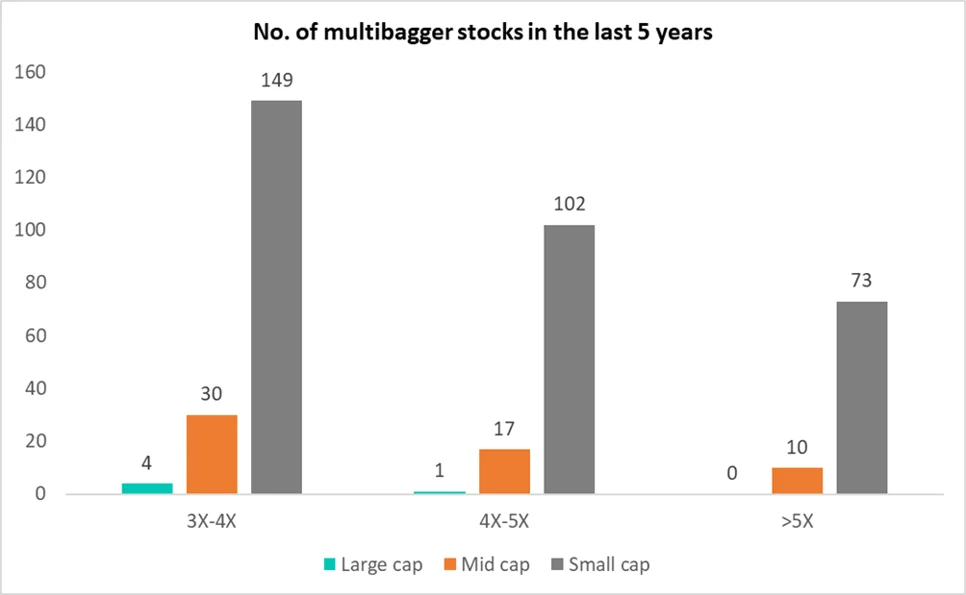

In the five years preceding April 2024, of all the companies that delivered greater-than-5X returns, 73 were small-caps. In contrast, only 10 were mid-caps, and not a single one was a large-cap.

Even if we expand the universe to companies that delivered 3X-5X returns, 80%+ were small caps

Source: NSE, DSP. Data as on 23 April 2024. (Top 1000 companies considered for analysis.)

So buying small-caps should pretty much guarantee higher returns, right?

No: the broader small-cap segment also includes poor-quality small-caps. For every success story in this segment, you’ll find multiple failures as well.

The solution? Use quality as a decisive investment criterion.

Does better quality win more?

The short answer: Yes.

To see the dramatic difference quality makes when it comes to small-caps, let’s consider two small-cap indices and see how they compare in terms of average performance:

-

The Nifty Smallcap 250 index, which tracks companies ranked 251-500 by market cap on the Nifty 500 index (without any regard for quality-oriented criteria).

-

The Nifty Smallcap250 Quality 50 index, which tracks just 50 companies from the above index on the basis of their “quality” scores.

1. Quality = better long-term performance

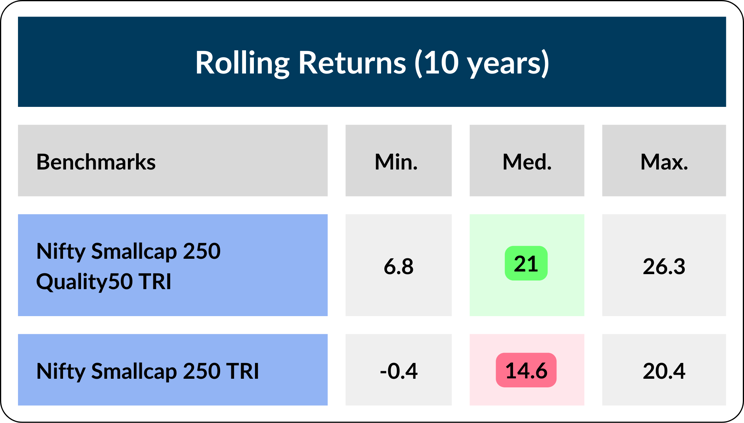

Considering data over almost two decades (specifically, since 1 April 2005), the average 10-year returns (median rolling) of the Small Cap Quality 50 index for a monthly SIP is significantly higher (21%) than for the overall Smallcap 250 index (14.6%).

Source: DSP; Data from 01 April 2015 to 01 April 2024.

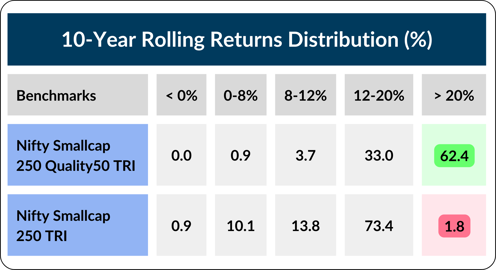

Further, the Small Cap Quality 50 index exceeded 20% CAGR a staggering 62% of the time, whereas the Smallcap 250 index delivered >20% CAGR in only 1.8% of all 10-year periods.1

Source: DSP; Data from 01 April 2015 to 01 April 2024.

So, a long-term SIP in higher-quality small-caps may greatly improve your odds of getting higher returns, both in absolute terms as well as when compared with the broader small-cap segment.

2. Quality = lower odds of capital loss

Data tells us that small-caps not filtered for quality were 8X more likely to lead to a permanent loss of capital than their higher-quality counterparts.

Between 2010 and December 2023, only 2% of the companies that were part of the Small Cap Quality 50 index lost wealth, in contrast to 16% of Non Quality 200 companies.2

3. Faster recovery after corrections

The small-cap space is currently believed to be “frothy”, which means that company valuations in that space are perceived as becoming increasingly detached from fundamentals.

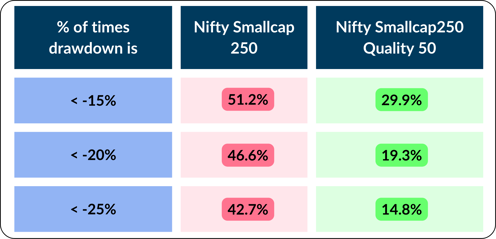

Based on historical data, when a major correction does happen, high-quality small-caps have historically seen less significant drawdowns and importantly, they also tend to recover more quickly.

The table below clearly shows how taking quality into account can result in less steep falls even within the small-cap space.

Source: NSE; Data as on 18 April 2024.

One more concrete instance of quicker recovery: it took the Smallcap 250 index around 6.4 years to get back to the high it had made in January 2008, while it took the Small Cap Quality 50 index only around 2.5 years to do so.3

But what about past performance?

Simply put, past performance belongs to those who invested in the past. If you're investing based on the previous few years' returns, you might be making a big mistake.

Rather than simply looking at a stock's performance over the previous few years, what you should also do is evaluate its median rolling returns.

What does this metric tell you? The 10-year median rolling returns for a given stock indicate the most likely returns you'd have made by investing in that stock over any 10-year period. Thus, this metric gives you a more accurate idea of the returns you can realistically expect from that stock over the next 10 years.

Investing based on point-to-point performance (i.e. the last 1 / 3 / 5 years) is like selecting a cricketer based on their performance in just the last match: this is only one data point, and tells you nothing about their consistency.

Having said that, while rolling returns can add more depth to your understanding of past performance while making investing decisions, outsized past performance should only be valued when backed with solid fundamentals.

Fundamentals? Metrics? What are those?

Given that understanding fundamentals is not easy and in-depth analyses take time, especially when it comes to risky small-cap stocks, here’s what you could do instead:

- Invest in small-cap mutual funds that focus on quality

- Make sure to invest via SIPs, so that you spread the risk over different price points

We can help. If you’d like to speak with an expert regarding how to invest in higher-quality small-caps, click here. Alternatively, you can simply click the button below.

1Data source: DSP. Data as on 01 April 2024. ‘Smallcap 250 index’ refers to the Nifty Smallcap 250 TRI, and ‘Small Cap Quality 50 index’ refers to the Nifty Smallcap250 Quality 50 TRI.

2Data source: DSP and NSE. Data as of December 2023.

3Data source: DSP and NSE data from this presentation. ‘Smallcap 250 index’ refers to the Nifty Smallcap 250 TRI, and ‘Small Cap Quality 50 index’ refers to the Nifty Smallcap250 Quality 50 TRI.

Industry insights you wouldn't want to miss out on.

Disclaimer

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in this scheme of DSP Mutual Fund. This note is for information purposes only. In this material, DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. All opinions/ figures/ charts/ graphs are as of the date of publishing (or as at the mentioned date) and are subject to change without notice.

Large-caps are defined as top 100 stocks on market capitalization, mid-caps as 101-250, small-caps as 251 and above. Data provided is as of April 2024 (unless otherwise specified). It is not possible to invest directly in an index. For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, Statement of Additional Information and Key Information Memorandum of the scheme available on ISC of AMC also available on www.dspim.com. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implications or consequence of subscribing to the units of the schemes of DSP Mutual Fund. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  FAQs

FAQs Reach us

Reach us

Comments

Write a comment

Thank you!

Your comment has been received. We will review it and post it shortly after checking it.